2022 Ford E-Transit Cargo Van Review

View 11 more photos

View 11 more photos View 11 more photos

View 11 more photos View 11 more photos

View 11 more photos View 11 more photos

View 11 more photos View 11 more photos

View 11 more photos2022 Ford E-Transit Cargo Van EV Insights

Estimated Range Based on Age

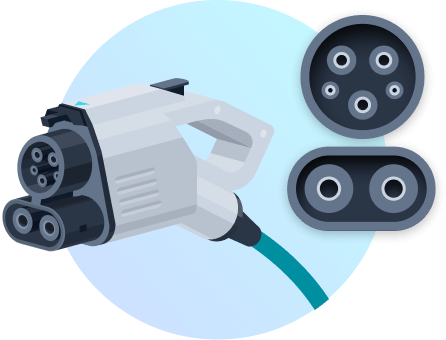

Charging

EV Battery Warranty

EV Tax Credits & Rebates

- Restrictions:

Funded by the Colorado Community Access Enterprise, the Vehicle Exchange Colorado (VXC) program offers $4,000 to income-eligible residents for the replacement of their old or high-emitting vehicles. Applicants with approval will receive this incentive at point-of-sale through participating authorized dealers for the purchase or lease of a qualified used Battery Electric Vehicle (BEV) or Plug-in Hybrid Electric Vehicle (PHEV). To qualify:

- Must complete a VXC rebate application and receive approval before rebates are issued.

- Income and household size must be below 80% of the area median income in an individual's county of residence.

- May qualify if showing proof of enrollment in eligible state or federal assistance programs.

- Final negotiated purchase price of used vehicle must be $50,000 or less.

- If leasing, lease term must be a minimum of two years.

- Model year of old or high-emitting gas or diesel vehicle must be at least 12 years old; if vehicle fails an emissions test in Colorado, no model year requirement.

- Vehicle must be currently titled and registered in Colorado without lien in the name of participant.

- Participant must be a Colorado resident, 18 years or older.

- Only one VXC rebate is allowed per tax household.

Additional information:

- Can be combined with Federal or State Tax Credits, but participant must verify combinability if applying for other EV offers for same vehicle purchase or lease.

For additional details and to apply, visit https://energyoffice.colorado.gov/vehicle-exchange-colorado

- Restrictions:

Under the Inflation Reduction Act of 2022, the Internal Revenue Service (IRS) offers taxpayers a Used Clean Vehicle Tax Credit equal to 30% of the sale price up to a maximum credit of $4,000 for the purchase of a used plug-in electric or hydrogen fuel cell vehicle. Beginning January 1, 2024, Clean Vehicle Tax Credits may be initiated and approved at the point of sale at participating dealerships registered with the IRS. Dealers will be responsible for submitting Clean Vehicle Tax Credit information to the IRS. Buyers are advised to obtain a copy of an IRS "time of sale" report, confirming it was submitted successfully by the dealer. Not every version of the vehicle models will necessarily qualify. Please check with the dealer/seller to determine the eligibility of your specific vehicle.

For the vehicle to qualify:

- Price cannot exceed $25,000.

- Need to verify the Vehicle Identification Number (VIN).

- Must be at least two model years older than the current calendar year in which the vehicle was purchased.

- Must be sold through a dealership, private sales not permitted.

- Not have already been transferred after August 16, 2022, to a qualified buyer.

For individuals to qualify:

- Must meet income eligibility, depending on modified adjusted gross income (AGI) and tax filing status.

- Must not be the first owner of the qualifying vehicle.

- Has not been allowed a credit under this section for any sale during the 3-year period ending on the date of the sale of such vehicle.

- Purchased for personal use, not a business, corporation or for resale.

To learn more, visit https://www.irs.gov/credits-deductions/used-clean-vehicle-credit

- Restrictions: Xcel Energy offers EV owners a rebate of up to $1300 towards the installation and cost of a Level 2 charging station.

To qualify for this rebate, the customer and/or charging station must meet the following requirements:

- Receive electricity from Xcel Energy.

- Have purchased or leased an electric or plug-in hybrid vehicle.

- Eligible customers can save up to $500. Income-Qualified customers can qualify for a $1,300 rebate.

Additional Information:

- Restrictions:

Poudre Valley REA, Inc offers EV owners a rebate of 50% up to $1000 towards the installation and cost of a Level 2 charging station.

To qualify for this rebate, the customer and/or charging station must meet the following requirements:

- Receive electricity from Poudre Valley REA, Inc.

- Have purchased or leased an electric or plug-in hybrid vehicle.

Additional Information:

- For full $1,000 rebate, members need to enroll in the DriveEV Smart Charging Rewards or Time of Use program. Without participation, members are eligible for a rebate of 50% up to $250 toward the cost of equipment and installation.

To learn more, visit https://pvrea.coop/for-members/rebates/ev-rebates/

- Restrictions: Edmunds is partnering with Treehouse, an independent provider of home EV installation services. Edmunds visitors receive a $100 discount when they contract with Treehouse for their home charger installation. Discount excludes permit, hosted inspection, and load management devices. Valid for 30 days.

To learn more, visit https://treehouse.pro/edmundsdiscount/

Cost to Drive

Am I Ready for an EV?

- EV ownership works best if you can charge at home (240V outlet)

- Adding a home charging system is estimated to cost $1,616 in

- Edmunds is partnering with Treehouse, an independent provider of home EV installation services. Learn more about the installation services partnership

Ford E-Transit Cargo Van Owner Reviews

Most Helpful Owner Reviews

Trending topics

Never pay for gas again!

4 out of 5 starsAfter 10 days had it towed. No transmission

1 out of 5 stars2022 E-Transit Cargo Van Highlights

| Base MSRP Excludes Destination Fee | $50,185 |

|---|---|

| EV Tax Credits & Rebates | $10,400 |

| Engine Type | Electric |

| Seating | 2 seats |

| Cargo Capacity All Seats In Place | 246.7 cu.ft. |

| Drivetrain | rear wheel drive |

| Warranty | 3 years / 36,000 miles |

| EV Battery Warranty | 8 years / 100,000 miles |

Safety

- Back-up camera

- Lane Departure Warning

- Tire Pressure Warning

- Stability Control

- Pre-collision safety system

- Post-collision safety system

People who viewed this also viewed

| Starting at $47,400 |

| 5.0 average Rating out of 1 reviews. |

| Starting at $59,995 |

| Starting at $56,400 |

Related Used 2022 Ford E-Transit Cargo Van info

Vehicle reviews of used models

- Lincoln Aviator 2020 Review

- Acura RDX 2020 Review

- Hyundai Santa Fe Hybrid 2021 Review

- Mercedes Benz GLC Class Coupe 2020 Review

- Mclaren 720S 2021 Review

Shop similar models

- Used Ram Promaster-ev-cargo-van 2025

- Used Mercedes-benz Esprinter 2025

- Used Smart Fortwo 2018

- Used Smart Eq-fortwo 2019

Popular new car reviews and ratings

- 2025 Grand Wagoneer

- New Kia Seltos

- New Ram ProMaster Window Van

- New McLaren Artura

- New GMC Sierra 1500

- New Land Rover Range Rover Evoque

- New McLaren 750S Spider

- 2026 Cadillac XT5 News

- 2025 Mercedes-Benz GLB-Class

- 2024 Audi A4

Research other models of Ford

- New Ford F-350 Super Duty

- New Ford Escape

- 2025 Ford F-250 Super Duty

- New Ford Ranger

- New Ford Transit Wagon

- 2024 Ford F-250 Super Duty

- Ford F-250 Super Duty 2024

- 2024 Ford Bronco Sport

Other models

- Used Infiniti QX30 in West Bend, WI 2019

- New Kia Soul for Sale in El Paso, TX

- New Mercedes-Benz Amg-Gt for Sale in Dubuque, IA

- Used Lincoln Blackwood in Gainesville, GA 2002

- Used Porsche 718-Cayman in Collegeville, PA 2025

- Used Dodge Magnum in Kent, WA 2008

- Used BMW M in Savage, MD 2006

- Used Mclaren 675Lt-Coupe in Lake In The Hills, IL 2016

- Used Ford Focus-Rs in Papillion, NE 2018

- Used Chevrolet Tahoe in Everett, WA 2025