October Car Sales Strong, But Lower Than Predicted

October car sales remained relatively strong but were lower than analysts predicted likely for a variety of reasons than a single one.

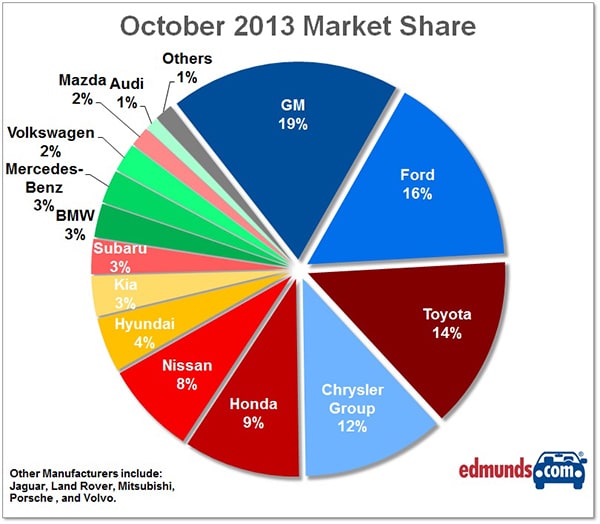

Automakers sold 1,204,872 light cars and trucks in October, up 10 percent from October 2012 and up 6 percent from September. That put the Seasonally Adjusted Annual Rate (SAAR) of sales at 15.2 million vehicles, higher than the 14.3 million in October 2012 but lower than the strong summer months and more in line with the March and April sales rate. October sales were lower than all forecasts by major auto analysts whose predictions ranged from a SAAR of 15.3 million to 16.6 million, with the consensus at 15.4 million. Edmunds.com forecasted a 15.5 million SAAR.

October 2013 was expected to generate a heftier increase over last October when Hurricane Sandy ravaged the East Coast. The hurricane had a particularly damaging impact on last October's car sales because it struck one of the biggest car-buying regions at the end of the month when most deals close. Edmunds.com calculated that about 20 percent of US car sales come from the New York/New Jersey region where Hurricane Sandy hit. And the storm came in the closing days of the month, a time that typically accounts for 30 percent of all sales in a month. For automakers like Honda, Toyota and Nissan, who rank No. 1, No. 2 and No. 3 in the region respectively in terms of sales volume, the impact was particularly damaging. For that reason, analysts thought the Japanese three were show healthy increases over a year ago. However, sales for the three brands actually came in lower than forecasts. Chrysler and Ford came in about where they were expected to, while General Motors was the only automaker to outpace forecasts.

The government shutdown mid-month may explain some of the lower-than-expected results. The geographic areas — Washington, DC, to the Northeast corridor — most likely felt the impact of the shutdown more than other parts of the country. The area accounts for a very large percentage of the nation's total vehicle sales and are big markets for the Japanese three.

Edmunds.com Senior Analyst Jessica Caldwell noted the lumpy pace of October sales. "The month started out at a fairly decent pace following a slow September, but then sales slowed when the government shutdown stretched to 16 days — longer than people anticipated. However, sales picked up right after the shutdown but then slowed again near month's end so that October saw a historically weak close," Caldwell said.

In addition to the shutdown and declining consumer confidence on Washington's behavior, the U.S. car market may also have experienced some pull ahead from buyers in August, when the SAAR hit a whopping 16.1 million vehicles, Caldwell surmised. August had a combination of healthy incentives, including loans with historically low interest rates, as automakers cleared out last year's inventory. October's incentives were the lowest registered since last October. While interest rates remain relatively low, they aren't as low as just a few months ago and fewer zero-percent financing deals were available. Edmunds.com calculated that less than less than 8% of all loans made in October carried zero-percent rate, compared with July and August, when it was 11 percent. Loans also are growing longer. October saw an average loan length of 65.8 months,, among the highest since Edmunds.com began keeping records in 2002.

"Savvy consumers are trained to look for those deals at summer's end," said Caldwell. They are also trained to look for year-end holiday deals. In fact, car buyers may have been held back from purchasing in October in anticipation of those Christmas red bow promotions. Caldwell predicts strong sales in November and December as a result, closing the calendar year out on a high note.

GENERAL MOTORS: GM sold 226,402 vehicles in October, up 16 percent from a year ago, on the strength of new products and the sell-down of soon-to-be-replaced ones. GM said retail sales were up 16 percent; fleet sales were up 14 percent, representing 21.5 percent of GM's total sales.

GM has been on a tear this past year introducing new versions of critically important models, including the Chevrolet Silverado and GMC Sierra pickup trucks launched in September, and high-profile cars, like the Chevrolet Corvette Stingray. The more than a dozen launches of new is accounting for 1 million in annualized sales fetching record prices, said Kurt McNeil, GM vice president, U.S. sales operations.

Sales of the Chevrolet Silverado rose 10 percent to 42,660 trucks; GMC Sierra sales rose 13 percent to 16,503 units. McNeil noted sales of the pair rose 62 percent from September to October with the new version accounting three-quarters of total sales. He said they are currently weighted more towards V8s and crew cabs, generating high average transaction prices, while demand for the V6 is growing.

Chevrolet sold 155,214 vehicles in October for a 15-percent increase. With the exception of vehicles being discontinued (Avalanche and Colorado), almost every Chevy model posted a healthy sales increase.

The 2014 Chevrolet Corvette Stingray scored a 237-percent sales gain to 3,929 sold. Of those, only about 300 were the previous generation model. The critically acclaimed redesign of the Chevrolet Impala had a 40-percent gain with the mix shifting in favor of retail sales instead of the previous 70 percent fleet mix. The Chevrolet Malibu, quickly tweaked in terms of design and technology for the 2014 model year after a failed redesign for 2013, posted a 64-percent gain. Of the 15,746 sold, about 55 percent were the new 2014 model year version. Chevy's small cars, the Sonic and Spark, continued to gain momentum with double-digit sales hikes. Likewise, big gains were posted by the venerable Equinox and Traverse crossovers. Camaro sales rose 11 percent. Cruze sales were off 16 percent, but the small car still had its best October ever. The large Tahoe and Suburban SUVs had huge gains as gas prices fall, they are being discounted to make way for the new versions and 45 percent of them went to fleets. Sales of the extended-range plug-in hybrid Chevrolet Volt saw a 32-percent sales decline despite GM lowering its price this summer.

Cadillac posted the smallest gain of any GM division — up 9 percent to 14,792 vehicles sold —as it awaits this fall's launch of the redesigned CTS, which had a 12-percent decline as it is in sell-down mode. GM said the CTS will have a full stock of inventory by the end of November. Likewise, Escalade models posted sales declines as they too are being sold out to make way for new versions. SRX sales slipped 3 percent. However, gains came from Cadillac' two newest cars: the award-winning ATS posted a hefty 120-percent sales gain of 2,782 sold, and the XTS was up 8 percent. GM claims Cadillac retail sales were up 12 percent in October, as its long-term strategy has been to wean itself off fleet sales. Further, GM said more than 60 percent of Cadillac buyers in October did not trade in a Cadillac.

Buick sold 17,555 vehicles, up 21 percent. GMC retail sales were up 25 percent. The hike was fueled by finally higher Regal sales, up 47 percent. Buick's volume leader, the Enclave crossover sales, had a 9 percent sales hike. LaCrosse was down 7 percent despite its recent freshening. Verano sales slipped 6 percent. The new Encore pitched in 3,602 sales.

GMC sold 38,841 vehicles, up 16 percent on the strength of the new Sierra, and the sell0down of the Yukon models. The Terrain, which had its best October ever, had a 7-percent increase. The recently freshened Acadia posted a 23-percent hike.

The new product keeps coming with the Chevrolet Silverado High Country and GMC Sierra Denali and heavy-duty versions of Chevy and GMC pickups hitting showrooms in the first quarter of 2014. , followed New Chevrolet, GMC and Cadillac full-size SUVs also arrive in the first quarter. Later in 2014, GM introduces redesigns of the Chevrolet Colorado and GMC Canyon mid-size pickups.

FORD: Ford Motor Co. sales in October were 191,985, an increase of 14 percent compared with October 2012. The month's controversy over the temporary federal government shutdown caused early concern, but any issues of consumer confidence apparently were short-lived, as Ford said it was the best October for retail sales since 2004.

With two months left in 2013, sales for practically every Ford model were up compared with the same period last year, while a strong October for the premium Lincoln brand pulled total sales to just 3 percent in arrears of last year's 10-month total, although Ford sales executives openly conceded Lincoln's turnaround is a project that will be years in the making.

Ford cars sales were particularly robust in October, their overall gain of 19 percent outpacing even the company's perennially strong pickups, which were up 14 percent for the month. The gain came largely on the pace of one model, however, the midsize Fusion sedan, which was up 71 percent in October to 21,740 sales as the company said recently installed volume from the Flat Rock, Mich., assembly plant began to make an impact on Fusion supplies.

A surprising gain of 30 percent for the Mustang specialty car to 6,918 sales might indicate some aren't concerned that an all-new generation of Mustang is coming next year, although full-year sales for the Mustang remained off by 8 percent at 66,083. Despite the overall car-sales strength, sales for a couple of Ford cars did decline for the month, including the Focus compact, off 17 percent on 15,108 deliveries, and a 20-percent drop for the C-Max to 2,530 sales.

Every Ford utility vehicle posted a sales gain in October, with the Escape compact once again leading the charge with its 22,253 sales for a 12-percent increase. The Edge midsizer was up 3 percent and was in the black by nearly the same amount for the first 10 months of the year. Sales for the popular Explorer were flat at 13,584, although the October performance kept the Explorer up 17 percent for year with sales of 149,431 for the first 10 months.

Ford officials proudly proclaimed the F-Series pickup line exceeded 60,000 deliveries for the sixth consecutive month in 2013, the pickup's October sales totaling 63,803; at 623,309 total sales for the first 10 months of 2013, the F-Series was pacing 20 percent ahead of a strong same period in 2012. October sales for the Transit Connect van jumped 19 percent to 3,169 and were up almost 18 percent year-to-date.

At Lincoln, a big month for the new-generation MKZ midsize sedan boosted total sales to 7,131 units, a 38-percent surge. The MKZ contributed 2,909 sales to Lincoln's total for the month and was the brand's bestseller, followed by the MKX midsize crossover with its 2,022 sales, a 26-percent increase. At 66,983 sales for the first 10 months of the year, Lincoln pulled to within 3 percent of the same period last year.

TOYOTA: Toyota Motor Sales USA Inc. reported sales of 168,976 in October, a 9-percent increase compared with October 2012, as an all-new Corolla compact car and the redesigned Avalon large car delivered big gains and the Lexus premium-vehicle unit posted a double-digit increase in a month when much of the industry worried the temporary shutdown of the federal government might curtail big-ticket purchases.

The presence of an all-new version of the seminal Corolla compact car drove the nameplate to a 13-percent gain for October on 23,637 sales. At the other end of the car-size spectrum, the Avalon full-size sedan convinced 5,148 buyers, a 266-percent increase compared with last year. But several other Toyota cars — and every model from the Scion small-car unit — were saddled with losses for the month, including a deep 70-percent plunge for the Yaris subcompact to just 775 sales and a 7-percent slip for the iconic Prius (to 15,263 deliveries) and even a 3-percent decline for the Camry, although its 29,144 sales would delight any carmaker.

Toyota's utility vehicles fared better overall (up 21 percent) in October, with the RAV4 compact crossover booming out a 61-percent increase on 17,590 sales and the Highlander midsize crossover reaching 9,323 buyers for a 5-percent gain. The only Toyota crossovers in the eight-model lineup to decline in October were the low-volume FJ Cruiser and Venza wagon.

The restyled Tundra full-size pickup sold 9,913 units in October for a 23-percent hike, and the Tacoma midsize pickup was up 1 percent on 12,351 sales. Year-to-date, the Tundra was up 10 percent, the Tacoma 17 percent.

At Toyota's Lexus luxury-vehicle division, total sales were 22,718 in October, a 14-percent jump. Lexus' gainers were led by the redesigned IS sedan, which was up 69 percent to 3,570 sales. The best-selling ES midsize sedan was flat in October at 5,997 sales while the LS flagship gained a healthy 26 percent to 1,055 units. But the GS rear-drive midsizer found just 1,293 buyers for the month, a 15-percent slide that left the relatively new car off 11 percent for the year, while the CT hybrid convinced just 842 buyers for the month.

All of Lexus' utility vehicles posted gains in October, though, led by a healthy 7,979 units for the best-selling RX (a 15-percent gain) and a plump 65-percent hike for the GX, which sold 1,498 units for the month.

For the first ten months, Lexus sales were up 12 percent to 213,479 sales.

CHRYSLER: Chrysler Group LLC reported October sales of 140,083 vehicles, up 11 percent from a year ago for the group's best October since 2007. Chrysler's strength came from the truck/SUV side of the ledger with sales up 15 percent; car sales up a meager 1 percent. Except for Fiat, every brand — Chrysler, Jeep, Dodge and Ram Trucks — posted a sales increase.

Six Chrysler Group vehicles logged their best October sales ever, including the Jeep Wrangler and Jeep Patriot, the Dodge Journey crossover, Dodge Dart compact car and the Dodge Challenger. October marked the Wrangler's seventh sales record this year, including an all-time sales record in May. The Ram Cargo Van also logged its best October sales ever.

Still, the star was the Dodge Durango, which has been posting months of gains but in October posted a whopping 59-percent increase to 5,120 SUVs sold. The spike is attributed the October launch of a new ad campaign for the Durango starring Will Ferrell as Ron Burgundy in the new Anchorman film. Shopping for the Durango on Edmunds.com soared after the commercials aired. Hefty Durango sales fueled a 12-percent hike for Dodge brand sales, which totaled 45,314 units. Only Avenger sales fell - by 29 percent. Dart sales were up a scant 3 percent to 5,617 cars, seemingly stalled in the 6,000 range month after month. Charger sales soared 60 percent. Challenger sales rose 21 percent. Caravan minivan sales climbed 9 percent. And sales of the Journey crossover edged up 7 percent. The all-new Viper had sales of 69 cars.

The Ram Truck brand's 22 percent increase to 31,264 trucks and vans sold was the largest sales gain of any Chrysler Group brand in October. The Ram 1500 posted an 18-percent gain to 29,846 trucks. Cargo van sales soared 120 percent 848 units. The ProMaster Van, on sale starting in October, had sales of 570 units.

The Jeep brand gained 7 percent to 36,379 utilities sold. The 2014 Jeep Cherokee, long awaited to replace the defunct Jeep Liberty, finally went on sale in October after a delayed launch, posting sales of 570 units. Other Jeep models also saw hikes: Compass up 68 percent; Patriot, up 33 percent; Grand Cherokee, up 20 percent; and Wrangler, up 4 percent.

Fiat sales fell 1 percent to 3,674 units. Of those, 2,378 were the standard issue Fiat with 2,378 sold. The new 500L kicked in sales of 1,296 cars.

HONDA: American Honda reported sales of 114,538 in October, a 7-percent increase compared with last October, as the CR-V compact crossover posted record sales for the month and Honda's upscale Acura division outperformed the Honda brand's gain by posting a 17-percent sales jump.

Honda consistently enjoys giant volumes on the CR-V and October brought 22,554 deliveries — a best-ever figure any October and a 12-percent increase over October, 2012. But CR-V's volume still couldn't equal either of Honda's cornerstone car models, with the Civic compact notching 27,328 sales for a giant 32-percent gain over last year and the Accord finding 25,162 buyers, although Accord's performance was 11-percent weaker than last October, shortly after the all-new model became widely available.

Honda also enjoyed big comparative gains of a respective 33 percent and 84 percent for the CR-Z and Insight hybrids, but actual volumes, at 325 units and 463 units, remain stunted. Honda's subcompact Fit, overdue for replacement, was off 1 percent on 3,735 sales.

For the Acura premium-vehicle unit, the redesigned MDX midsize crossover moved ahead of the strongly redesigned RDX compact crossover to be Acura's best-seller for the month, the MDX's 5,608 sales representing a 49-percent surge, while the RDX itself was up 25 percent on the strength of 3,333 deliveries.

Meanwhile, a heavy redesign for the RLX large car brought an outlandish 3,852-percent jump on a volume of 830 sales. The surprising ILX has emerged as the brand's passenger-car sales leader and in October the ILX was up 31 percent on 2,005 sales. The TSX and TL midsize sedans were off heavily for the month, however, while total Acura sales, at 135,126, were 6 percent ahead of the first ten months of last year.

NISSAN: Nissan North America sales rose 14 percent to 91,018 Nissan and Infiniti vehicles. Nissan Division set an October record of 81,866 vehicles, up 15 percent from a year ago. Infiniti sales edged 5 percent higher to 9,152 vehicles.

Nissan Division sales were led by an October record of 12,919 Rogue sales, up 53 percent. The Rogue is in sell-down mode as the new 2014 is prepared for launch in later November. Pathfinder posted a hefty 90-percent sales increase to 5,793 units. The all-electric Leaf bucked the trend of lower sales of the advanced propulsion cars by setting an October record of 2,002 sales, up 27 percent. Also posting gains were: the Versa including the new Versa Note, up 15 percent; Sentra, up 4 percent; Cube, up 49 percent, Juke, up 27 percent; 370Z, up 40 percent; and GT-R, up 29 percent. The volume-leading Altima had a 12-percent decline to 21,785 cars. The aging Maxima was off 9 percent. On the truck/utility side, the Frontier gained 72 percent but the Titan once again missed the full-size pickup truck boom, posting a 38 percent decline to a scant 984 trucks. Sales of other Nissan-branded trucks and utilities rose except for the Quest minivan and the Murano crossover.

At Infiniti, only the QX60 seven-passenger crossover gained a scant 4 percent and the new Q50 chipped in 2,556 sales. The rest of the product line saw declines, and some were hefty double-digit ones.

HYUNDAI: Hyundai Motor America posted 53,555 sales in a best-ever October for the brand that also represented a 12-percent increase compared with October 2012.

Most Hyundai models posted sales increases for the month, but the largest gains came from vehicles in two of the market's most robust sectors: midsize cars and crossovers. In October, the Sonata midsize sedan was up 18 percent on 19,872 deliveries and was the brand's best-selling model, while the Santa Fe midsize crossover doubled the Sonata's gain, its 36-percent jump coming on sales of 8,194 units.

"October was a bit of a roller coaster ride for the entire automotive sector so we feel pretty good about exceeding prior year sales results and posting our best-ever October performance," said Dave Zuchowski, executive vice president of national sales, in a release. "We expect continued economic and political stabilization throughout the final two months of 2013, which should ease uncertainty, boost consumer confidence and restore a robust growth curve for new vehicle sales."

Also gaining for Hyundai in October were the Accent subcompact, up 7 percent to 3,605 sales, while the Elantra compact car was Hyundai's second-best seller by volume but flat compared with last October on 14,876 deliveries.

The Equus rear-wheel-drive flagship found 361 buyers for a 13-percent gain, but perhaps hurt by Santa Fe's surge, Hyundai's smaller Tucson crossover slid 42 percent to 2,106 sales and Genesis line was off 12 percent on 1,944 sales. The Veloster's 2,175 sales marked a 12-percent decline, driving the sporty coupe to a 17-percent slide for the year.

For the first 10 months of 2013, Hyundai totaled 601,773 sales, a pace putting the brand 2-percent ahead of the same period last year.

KIA: Sales at Kia Motors America in October were 39,754, down 6 percent compared with October, 2012. It was a mixed month for the brand's general upward surge of the past two years, with slight declines for several volume models offset by incremental new volume from the new Cadenza large car and modest gains for a handful of nameplates.

The brand's best-selling model, the Optima midsize sedan, was off by 13 percent to 11,492 units, a shortage that even the addition of 1,100 additional sales from the all-new Cadenza full-size car couldn't quite offset. The Forte compact car slid to 4,706 sales for the month, marking a 20-percent drop.

But Kia's Soul compact hatchback, heavily revised for 2014 model year, eked out a 3-percent gain on 8,240 sales and another small car, the Rio subcompact, posted 2,874 sales for a 10-percent gain. Kia's crossover models also were mixed, with the Sportage compact enjoying a 12-percent gain on 2,513 sales, but the Sorento midsizer's 8,142 sales marked a 15-percent slide.

For the first ten months of 2013, Kia's sales totaled 456,137, roughly five percent off last year's 477,366 total sales for the same period.

SUBARU: Subaru of America sold 34,483 vehicles, a 32-percent increase. Already for the year to date, Subaru has sold 347,890 vehicles, up 28 percent from the first 10 months of 2012, has surpassed its previous annual sales record set in 2012 with two months of sales remaining in the year. That means Subaru is on track for its fifth consecutive year of record sales.

The volume-leading Forester, redesigned this year, had sales of 12,581 utes, a whopping 137-percent increase. The XV Crosstrek became the third best seller for Subaru with a 182-percent increase in sales to 4,886 units. Other volume leaders registered sales declines: Impreza down 2 percent, Legacy off 14 percent and Outback down 20 percent. The Impreza WRX gained 23 percent. The BRZ sports car nearly doubled sales to 780 units. Tribeca sales totaled a scant 101 units, a 45-percent drop.

BMW: The BMW Group, including the BMW and Mini brands, sold 33,274 vehicles, up 3 percent from a year ago. Year-to-date, the BMW Group sales are up 11 percent to 295,474 vehicles.

"The momentum of October is a good indicator of what's ahead in the final 60 days of the year, especially with sales of the new X5 and the 4 Series beginning to have an impact," said Ludwig Willisch, President and CEO, BMW of North America. "All of the leading indicators — sales, order rates, showroom traffic, finance applications — are up, very good signs."

BMW-brand vehicles increased 4 percent to 27,574 vehicles. Year-to-date, BMW brand sales are up 13 percent to 240,139 vehicles. In October, the highest percentage increase in sales went to BMW X, up 60 percent. The BMW 3 Series and the newly launched 3 Series based 4 Series, had a 20 percent increase. Sales of the BMW 5 and 6 Series increased sales 19 percent and 20 percent.

Mini's sales in October declined 3 percent to 5,700 cars. Year-to-date, Mini sales are up a scant 2 percent at 55,335 cars.

MERCEDES-BENZ: Mercedes-Benz USA (MBUSA) sold 32,620 units for the Mercedes-Benz, Sprinter and smart model lines, a 22-percent increase.

Mercedes-Benz retail sales set a new October record of 30,069 vehicles sold, up 25 percent, pushing year-to-date sales up 14 percent to a record 245,125 units. "It's been an extraordinary year for the brand, embodied in two cars — the CLA and the S-Class — as stunning as they are technologically fit," said Steve Cannon, president and CEO of MBUSA. "More importantly, October sales show they're resonating with customers. The recently-launched CLA is already one of the top volume models and our flagship S-Class, just rolling into dealerships, is up 75 percent…We're looking toward a record finish in the final stretch of 2013."

Mercedes-Benz's October sales were led by the C-, E- and new, entry-level CLA-Class model lines. The C-Class had sales of 6,548 cars, down 14 percent, followed by the E-Class with sales of 6,456, up 23 percent. The CLA was the third best seller adding 4,895 sales.

BlueTEC diesel models totaled 1,536 units, up 60 percent from a year ago and up 10 percent for the year at 13,368 vehicles. Sales of AMG models were up 49 percent at 729 units. Sprinter had sales of 2,038 vehicles, up 22 percent. Smart sales fell 49 percent to 513 cars.

Adding year-to-date volumes of 16,978 for Sprinter Vans and 7,450 vehicles at smart, MBUSA's year-to-date totals reached 269,553 units, making this the best October in the company's history.

VOLKSWAGEN: Volkswagen of America sold 28,129 vehicles in October, down 18 percent for the month. For the year, Volkswagen sales are down 4 percent to 342,962 vehicles. The German automaker has a goal to sell 800,000 vehicles a year in 2018.

In a sales day conference call, Jonathan Browning, Volkswagen of America president and CEO, disputed media reports calling VW's sales decline as disappointing. "We are on a long-term journey and always have indicated sales growth would moderate from the 2009 to 2012 timeframe when we doubled the size of our business," Browning said. He insists Volkswagen remains on track to sell more than 400,000 vehicles for a second consecutive year — "only the second year in 40 years where we're above that level. That is progress so it is important to see our sales in that context," he said.

Only Beetle and GTI sales were up, 5 percent and 8 percent respectively. Jetta and Passat sales fell 13 percent. Tiguan sales dropped 22 percent, Touareg sales fell 43 percent. Volkswagen is discontinuing the Routan minivan built by Chrysler and is awaiting the arrival of the next-generation Golf. Browning claims those two factors account for Volkswagen's year-to-date reduction in sales.

Diesel models accounted for 24.2 percent of October sales and 22 percent year to date — the most for any first 10 months on record. Of Passat sales, 33.3 percent were diesel.

MAZDA: Mazda sold 19,738 vehicles, up 6 percent from a year ago, for its best October since 2007. That pushed year-to-date sales 5 percent higher to 240,229 vehicles.

The recently redesigned Mazda6 celebrated its best October since 2008 with 105-percent sales hike to 3,100 cars sold. The CX-5 had a 54-percent increase to 5,833 vehicles sold. The rest of Mazda's line saw sales declines: Mazda2, down 35 percent; Mazda3, down 19 percent; Mazda5, down 13 percent, and CX-9, down 8 percent.

Vehicles with Skyactive technology accounted for 78 percent of Mazda's October sales.

AUDI: Audi sold 13,001 vehicles, up 11 percent from a year ago to set a new October record. Audi sales year-to-date increased 13 percent to 127,412 vehicles sold. "We are confident that 2013 will stand as our fourth-straight record year," said Mark Del Rosso, Executive Vice President and Chief Operating Officer, Audi of America.

Audi SUVs led the charge with the Q5 up 39 percent, the Q7 up 39 percent. On the car side, the A6 had a 14-percent gain, TT sales rose 62 percent and A5 gained 14 percent.

JAGUAR LAND ROVER: Jaguar Land Rover North America sold 5,801 vehicles, up 52 percent from a year ago. Jaguar sales were 1,515 units, up 117 percent; Land Rover sales were 4,286 units, up 37 percent. Year to date, Jaguar Land Rover sales are up 19 percent with Jaguar up 36 percent and Land Rover up 14 percent.

Range Rover sales totaled 1,184 utilities, up 194 percent for its best October ever. Also setting an October record was the Range Rover Evoque, which increased sales by 49 percent to 959 units. Jaguar XF was the volume and growth leader for the brand with 611 cars sold, up 120 percent. XJ sales were up 75 percent to 454 cars. F-Type convertible sports car added 353 sales.

MITSUBISHI: Mitsubishi Motors North America sold 4,972 vehicles up 10 percent from a year ago, marking the Japanese brand's best October since 2010. Sales of the U.S.-built Outlander Sport led the way with 2,009 units sold, up 20 percent. Outlander sales were up 66 percent. The Mirage, reaching dealerships in additional markets in November, had sales of 475 units.

VOLVO: Volvo Cars of North America sold 3,919 vehicles, down 7 percent. Year-to-date sales also are down 7 percent. In October, the S60 sports sedan was the top seller with 1,276 units sold, up 11 percent. The XC60 crossover finished the month right behind with 1,244 units sold. Showing increases were S80, up 7 percent, XC70, up 6 percent and C70 up 38 percent.

PORSCHE: Porsche Cars North America sold 3,562 vehicles, up 11 percent from a year ago. Year-to-date, Porsche has sold 35,111 cars in the U.S., 24 percent ahead of last year's total of 28,226, thus surpassing the entire 2012 sales volume of 35,043.

"Having sold more cars in the first 10 months of this year than the entire total of our 2012 record year is quite a feat, and it is rewarding to see that nearly half of our sales success is carried by our two-door sports cars," said Detlev von Platen, President and CEO, Porsche Cars North America, Inc. "This bodes well for the final two months.

Sale of the volume-leading Cayenne totaled 1,669 cars, up 2 percent. Panamera sales rose to 501 units from 467. Sales of the 911 rose to 749 units, up from 590 units last October. Sales of the Boxster/Cayman totaled 644 units, up from 457 cars. Two-door sport cars, consisting of 911, Boxster and Cayman, are accounting for about 40 percent of Porsche's sales this year.