First Look at December Sales

December is a tricky month to forecast, especially early in the month. Generally, things start out OK, really slow down after the 15th, and then finish especially strong during the days between Christmas and the New Year. This year, a number of factors are lining up to support December sales, including improved supply, ample advertising of deals, deal-seeking buyers, deferred sales recovery, and increased consumer confidence. We also have special tax treatments that may end December 31st to consider. These aren't available for most buyers, but past experience has shown that in similar situations there is enough to give sales an extra boost.

So, with all of this as a disclaimer, it is good to be able to say that mid-month, sales are trending to finish even above November's pace. This is no easy task, considering that the SAAR algorithm assumes a 30% lift from November to December anyway.

Right now, retail sales look to end up around 1043k units, for a SAAR of 11.4m. This compares with 810k units, or 11.1m SAAR last month. Assuming a fleet mix of around 18% (about the same as last month — historically November and December have about the same fleet mix), then December will have sales of around 1273k and a SAAR 13.9m. This compares with 994k units and a SAAR of 13.6m last month).

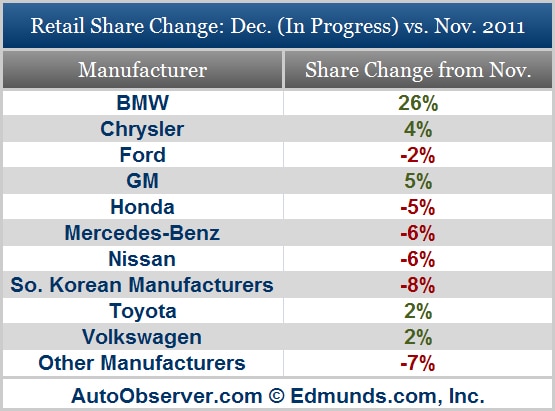

Retail share-wise, compared to the same period last month, BMW is up significantly. Chrysler, Toyota and VW are up slightly. The South Koreans, Nissan, Honda and Mercedes Benz are down slightly. (Mercedes Benz had a strong start in November.)

Details are below: