Credit for New Car Buyers Is Back - <em>Or Is It?</em>

Auto lending is back. Dealer-financed new car sales have rebounded and are on track this year to surpass 2007 levels by 13 percent, despite total sales remaining 11 percent below 2007. Lenders also have brought more subprime borrowers back into the auto loan market: the share of new car loans to subprime borrowers and the average credit score on new car loans both returned to 2007 levels in recent months.

But contrary to appearances, auto lending has not yet fully recovered. A sharp decline in the availability of funding from non-dealer sources ("cash") has caused some of these buyers to use dealer-financing instead, increasing dealer-financed sales. Additional former "cash" buyers will likely shift to dealer-financing given the slow recovery of "cash" sources such as home equity. Moreover, pent-up demand from consumers unable to obtain financing during the recession has not fully released and will continue to contribute to auto sales growth as these consumers get access again to credit. As a result, the auto industry can continue to count on expanding credit - a key driver of auto sales growth during the recovery to date - to boost sales for the foreseeable future.

The Fall and Rise of Dealer-Financed Sales

When credit markets collapsed during the Great Recession, new car sales fell right along with them. Given that 44 percent of car sales on average from 2002 to 2007 were dealer-financed (loans set up by dealers through the OEM's captive financing arm or a bank), many consumers cut off from credit no longer could afford a new car. New car sales funded by dealer financing reflected this trend and fell 22 percent from 2007 to 2009. Sales funded by leases and "cash" (actual cash or funds from non-dealer financing sources including personal loans, home equity line of credit withdrawals, and cash-outs from refinancing) dropped even more. Since 2009, sales funded by "cash" have grown relatively less than sales funded by other sources, with some buyers shifting from "cash" funding to dealer financing. At the same time, many buyers who traditionally used dealer financing have come back to the market as credit expanded post-recession. Accordingly, the volume of dealer-financed new car sales has grown since its recession low in 2009 - to 1.3 percent below 2007 levels in 2011 and to 13.1 percent above 2007 levels in 2012.

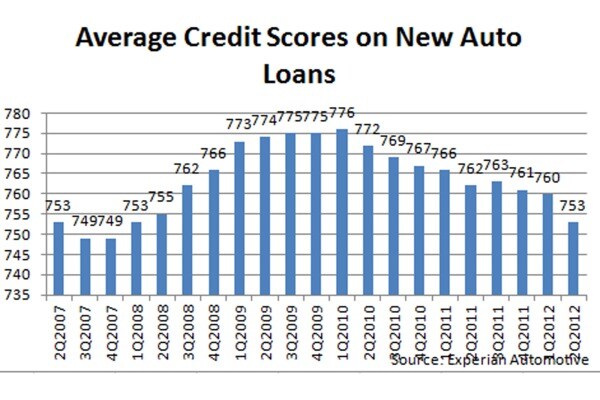

This rebirth of auto lending has included both prime and subprime borrowers. In particular, subprime lending has shown increasing strength during the past couple years. Recently, the share of new car loans to subprime borrowers increased from a low of 17.6 percent in the second quarter of 2009 to 25.4 percent in the second quarter of 2012, according to data from Experian. That's slightly above the 25 percent share in the second quarter of 2007. Average credit scores on new car loans also reflect the subprime lending revival. Experian data reveal that these scores fell from 774 in the second quarter of 2009 to 753 in the second quarter of 2012 - the same as the second quarter of 2007.

Still Room to Grow

These data appear to suggest that dealer-financed sales have recovered and that any additional growth in new car sales from expanding credit will be insignificant. Such a conclusion would ignore several key components of the bigger picture.

First, there is room for growth in new car sales. New car sales are expected to remain 11 percent below 2007 levels in 2012 - at 14.4 million versus 16.1 million. Although base demand for new cars likely dropped after the housing bubble burst and subprime lending contracted, eliminating some buyers from the market on an ongoing basis, some of this decrease has been reversed by a larger driving population. An estimated five to ten million licensed drivers on net have been added to the market since 2007. During this time, scrappage exceeded sales for at least two years and the number of vehicles in operation fell from a record 242.1 million in 2008 to 240 million in 2010 before regaining 500,000 vehicles in 2011. As a result, the number of vehicles per driver fell from a pre-recession high of 1.17 to an estimated 1.13 in 2011 - equivalent to 2004 levels. While some decline in the ratio of vehicles per driver would naturally result from more austerity following the recession, it is still likely that sales will increase further. The rate of new car sales per licensed driver for 2012 is projected to remain 20 percent below the pre-recession average from 1990 to 2006. Even returning to that period's low from the 1991 recession year - a rate10 percent above the 2012 rate - would generate base sales of nearly 16 million per year and that does not include any release of pent-up demand.

Funding Additional Sales Growth

Dealer-financed sales may even be able to contribute to additional sales growth. Although dealer-financed sales may be above pre-recession levels, sales funded by "cash" sources remain close to 40 percent below their 2007 total. Some of these "lost" "cash" sales may have fallen out of the new car market because some car buyers could not secure funding or chose to buy a used car while others have likely been funded by loans or leases already. But the sheer volume of lost sales in this category suggests that not all recoverable sales have come back to market. Cash funding should remain limited until more progress is made in the still nascent recovery of the housing market. Accordingly, there should still be room for growth in dealer-financed sales from former "cash" buyers.

Even if dealer-financed sales exceed 2007 levels by 13.1 percent as expected in 2012, these sales are inflated by lost sales to former "cash" customers and are arguably not "fully recovered." The 2012 sales will not include all of the pent-up demand from buyers who were unable or unwilling to borrow during the recession and recovery to date, including many subprime borrowers. The share of loans to subprime borrowers fell dramatically during the recession. At the same time, the overall total of dealer-financed sales also dropped, meaning that the smaller subprime share came from a smaller pie until 2011. Since the recession, credit has expanded again but not everyone who qualified for new car loans pre-recession still qualifies. On the other hand, the potential new car-buying population has increased as new licensed drivers were added. The subprime borrowing population in particular has likely increased over 2007 levels as job losses and decreased housing wealth eroded the credit worthiness of some former prime borrowers. Still, even if the number of subprime borrowers who qualify for and take out new car loans each year is no higher than in 2007 (roughly 1.6 million), then some 1.8 million would-be subprime buyers did not get loans from 2008 to 2011 and slightly less than half of these sales have not been made up to date. Recovery of these "lost" sales should further grow auto sales in the next few years.

Lacey Plache is the Chief Economist for Edmunds.com. Follow @AutoEconomist on Twitter.