- New survey data from Edmunds shows car shoppers are already accelerating or delaying purchases in anticipation of potential tariff-driven price hikes.

- More than half of buyers say they understand how tariffs will affect vehicle prices, which could potentially fuel proactive (and sometimes unpredictable) shopping decisions.

- Used and especially certified pre-owned vehicles are drawing more interest, but tight inventory may limit relief from rising costs.

Tariff Uncertainty Is Already Shaking Up Car Buying Decisions

Even before significant price changes take hold, Edmunds data shows consumers are adjusting in anticipation

President Trump’s renewed push for tariffs in his second term has ignited uncertainty across the auto industry, bringing fresh challenges just as the market was finding its footing after years of pandemic-driven volatility. Recent court rulings have made it harder for consumers and industry players alike to interpret what’s unfolding and what the consequences mean for their wallets.

So far, though, the actual impact of tariffs on the automotive market has been more muted than many expected. According to Edmunds data, key indicators like average transaction prices (ATPs) for new vehicles have largely stayed in line with seasonal norms: In April 2025, the ATP for new vehicles was $48,422, up 2.2% from April 2024's $47,385 and up 2.7% from March 2025's $47,148. While there have been some targeted moves — such as automakers adjusting suggested retail pricing on select models or limiting availability of certain vehicles — these actions haven’t yet translated into widespread disruptions.

While the numbers haven't moved significantly, car shoppers are already signaling that they’re preparing for change. If tariffs remain in place, broader market disruption may follow.

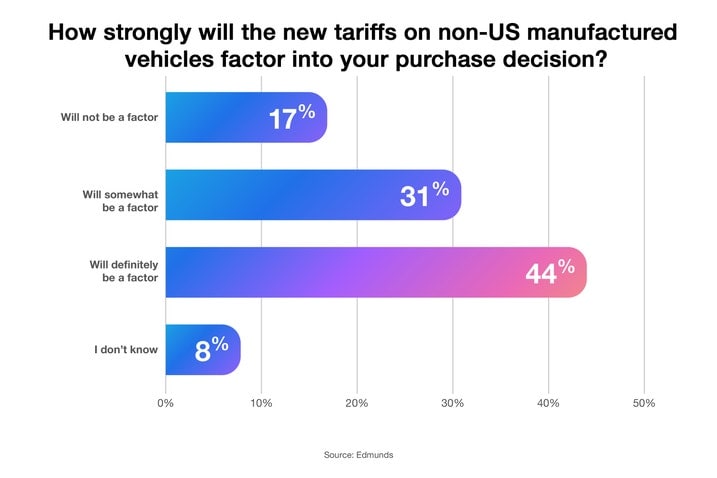

In a recent Edmunds survey of in-market shoppers,1 44% said tariffs will definitely influence their purchase decision, and another 31% said tariffs will somewhat factor in. Just 17% said tariffs wouldn't impact their decision at all.

Tariff anxiety is spurring some pull-ahead purchases

Beyond actual price changes, the perception of what might happen appears to be influencing behavior. Edmunds data shows that buying activity in March and early April was elevated relative to expectations, which suggests that some shoppers were motivated to accelerate their car-buying timeline in anticipation of tariff-related price hikes. Broader market indicators like the seasonally adjusted annual rate (SAAR) also showed a seasonal lift during this period. This kind of "pull-ahead" behavior isn’t unusual when consumers feel a shift is coming — even if that shift hasn’t fully materialized yet.

Shoppers say they understand tariffs, and that confidence is driving action

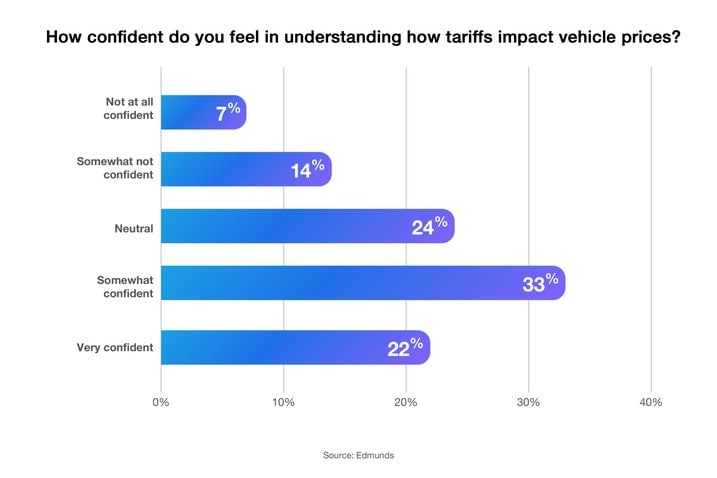

Many shoppers believe they have a good understanding of how tariffs will affect the market. According to Edmunds' survey data, 55% said they're somewhat or very confident in their understanding of how tariffs affect vehicle prices. Only 21% said they weren’t confident. Whether or not that confidence is well placed, this level of awareness could make consumer response even more turbulent in the weeks ahead.

Purchase timing is being pulled in two directions

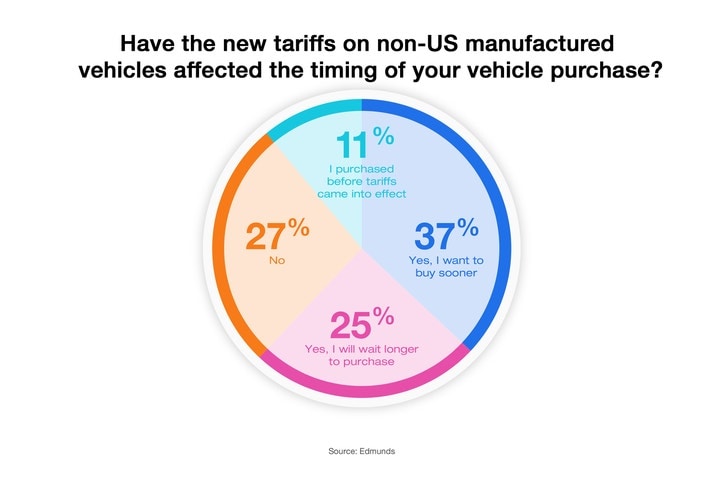

One of the most immediate ways tariffs appear to be influencing consumer behavior is in purchase timing, which is particularly tricky right now given the uncertainty around how long these tariffs might last. The volatility of the situation is likely making it difficult for shoppers to know whether to act quickly or hold off. According to Edmunds' survey data, 37% of in-market shoppers say they plan to buy sooner because of tariffs, while 25% say they’re choosing to delay their purchase.

More consumers set their eyes on used vehicles as a strategic alternative

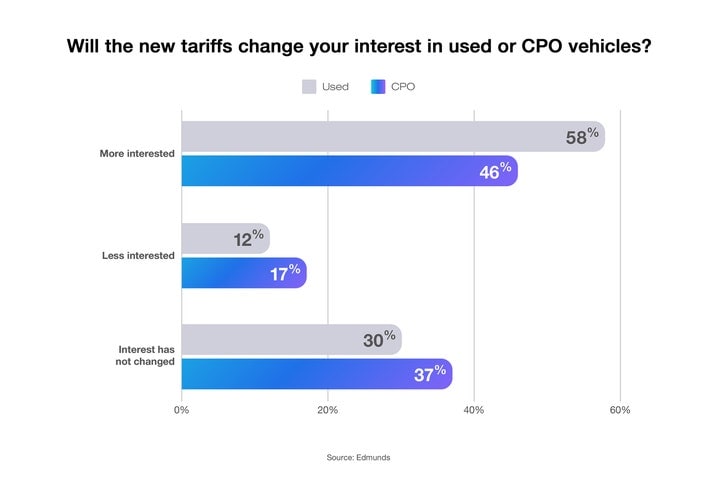

Edmunds' survey results show that shoppers are already reevaluating their options in light of tariff concerns: 58% of respondents said they’re more interested in used vehicles, and 46% of those said they're more inclined to consider certified pre-owned (CPO) vehicles specifically.

Edmunds data shows there is a growing perception among shoppers that used vehicles could be less affected by tariffs, especially in a market where new vehicle prices have already climbed 29% since March 2019, even before tariff-related effects have fully taken hold.

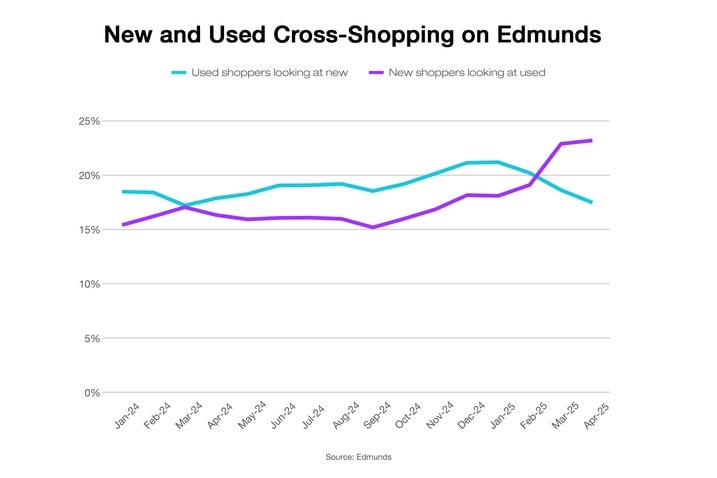

That sentiment appears to be surfacing in real car shopper behavior: Edmunds site data reveals a measurable uptick in new-car shoppers also browsing used inventory.

But an already tight used market may not offer much relief

Shoppers’ movement into the used market isn’t unexpected, but it will likely add pressure to an already constrained environment. Increased demand will likely drive prices higher, creating a challenging market for both consumers and dealers. Compounding the issue is the limited availability of near-new used inventory, a lingering consequence of historically low leasing volumes during the height of the microchip shortage three years ago.

That shortage is now catching up to the used market, creating a tough situation for dealers who need more used vehicles to meet rising demand and for consumers who may now be priced out of both new and newer-used options. The used market may offer some relief from new-vehicle pricing pressures, but prices can still fluctuate due to current market disruptions.

Tariff anticipation and its ripple effects across the industry

Buying a car is often a high-stakes financial decision, and for some shoppers, the added uncertainty around tariffs can introduce new stress. From the pressure to act quickly to the fear of paying more later, this environment could shift the emotional tone of the car-buying process. The typical sense of excitement may now be clouded by second-guessing and financial anxiety.

And it's not just shoppers who are likely to feel the impact — automakers and dealers are also navigating uncharted territory. Forecasting demand is likely becoming far more challenging when buying patterns are this disrupted. With so many consumers rethinking their timelines, traditional models built around seasonality and historical trends could start to lose their predictive power as well as the adjustments that will need to be made — or not made — to the vehicles themselves.

1Edmunds’ data for this report is based on a consumer sentiment survey conducted in May 2025 among car shoppers who have purchased a vehicle previously and have indicated they are planning on purchasing a vehicle in the next six months. N=500.

Edmunds says

Tariff-related shifts go beyond pricing: They may be changing the psychology of the car-buying process in real time. And as legal challenges continue to test the boundaries of U.S. trade policy, consumers and dealers alike must stay agile in an environment where uncertainty could outlast the tariffs themselves. For automakers, the pressure runs even deeper: Those with the broadest global footprint and most efficient cost structures will likely be the best positioned to withstand the volatility of shifting policies, pricing dynamics and consumer demand.

For more information on how the tariffs work and how automakers are responding, read How Are Automakers Responding to the Tariffs?

by

by  edited by

edited by