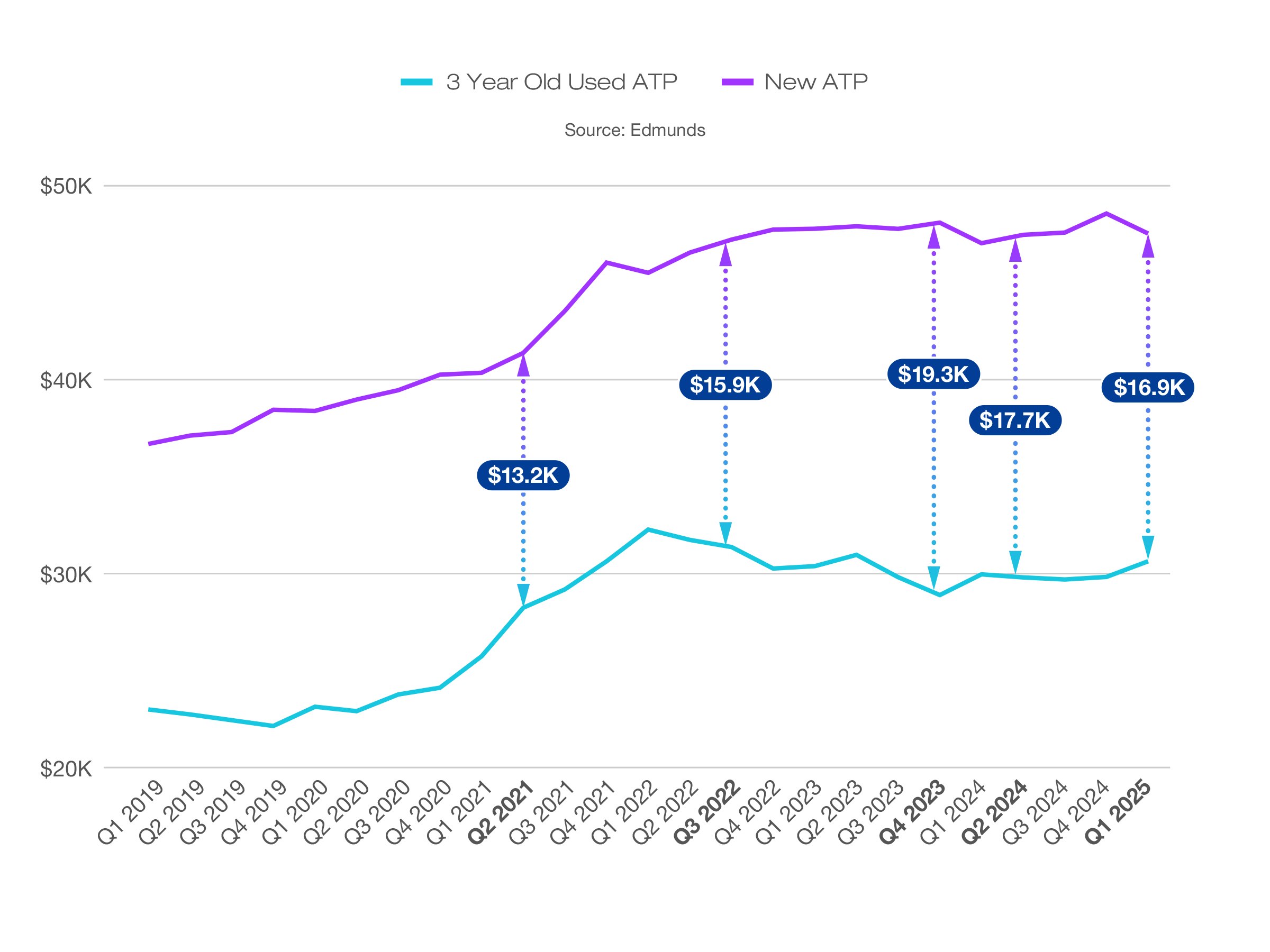

- The average sales price of 3-year-old used vehicles surpassed the $30K mark in Q1 2025, narrowing the gap with new car prices to under $17K for the first time since 2022.

- Due to unexpected market swings, 3-year-old lease-return values are coming in higher than automakers originally forecasted — offering some drivers unexpected trade-in advantages.

- Tariffs on foreign-assembled vehicles may cause sharp differences in resale values, with impacts varying at the model level rather than uniformly by brand.

3-Year-Old Used Vehicle Prices Surpass $30,000 for the First Time Since 2023 as Supply Pressures Mount

Edmunds data shows near-new supply constraints from COVID-era chip shortages pushed used prices higher in Q1, with additional upward pressure expected as tariffs reshape new-vehicle supply

Just as the used vehicle market was settling into a period of relative stability in 2024, early signs of renewed pricing pressure began to emerge in Q1 2025.

New-car inventory has mostly rebounded from the chip shortage of the early 2020s, evidenced by average transaction prices (ATPs) leveling off and incentives making a cautious return.

But below the surface, deeper supply challenges are now beginning to take shape in the used market. A sharp drop in leasing through 2022 and 2023, and fewer sales overall due to low supply, means far fewer lightly used vehicles are returning to dealer lots in 2025. The average age of trade-ins rose to 7.6 years in Q1 2025 — up from 7.3 years a year ago and the oldest trade-in age Edmunds has recorded since Q1 2019 — as more consumers returned to the market with older vehicles, further tightening near-new inventory.

Add in the looming impact of tariffs on new vehicle pricing and availability, and it’s become clear that the mild price increases seen in Q1 could mark the early stages of a broader shift in the used market.

Near-new prices rise, lot times stretch as inventory tightens

The average transaction price for a 3-year-old used vehicle was $30,522 in Q1 2025, up 2.3% from $29,844 a year ago — and marking the first time this figure has surpassed $30,000 since Q2 2023, according to Edmunds data. This increase in price was accompanied by longer lot times at used-car dealerships: The average days to turn — the number of days a vehicle sits on a dealer lot before a sale — for used vehicles was 38 days, four more days than a year prior and the highest Edmunds has on record since Q1 2021 with the same 38 days to turn.

The longer lot times paired with higher average transaction prices for 3-year-old used cars show that dealers are likely maintaining higher asking prices and demonstrating a willingness to wait for the right buyers given the lower supply. The effect of the limited number of lightly used vehicles to purchase is reflected in the average age of used vehicles listed on Edmunds rising from 5.7 years old in March 2024 to 6.1 years old in March 2025.

The price gap between new and near-new vehicles shrinks

The gap between average new and used vehicle prices has held relatively steady over the past year, hovering around a $17,000 difference as market conditions returned to relative normalcy compared to the major pricing swings earlier in the decade.

But in Q1 2025, that stability began to show signs of strain: The gap between the average transaction price of new and 3-year-old used vehicles narrowed to $16,970, marking the first time it has fallen below $17,000 since Q3 2022. This change signals the early stages of renewed pricing pressure in the used market.

That price stability is now poised to experience more significant turbulence in the quarters ahead as both new and used market fundamentals evolve. The biggest culprits for the imminent changes are a diminished supply of off-lease vehicles returning to the market in 2025, combined with regionally targeted tariffs potentially driving scarcity of select new models. These factors could trigger a cascading effect of higher used prices.

While new vs. used prices inch closer, resale values are harder to predict

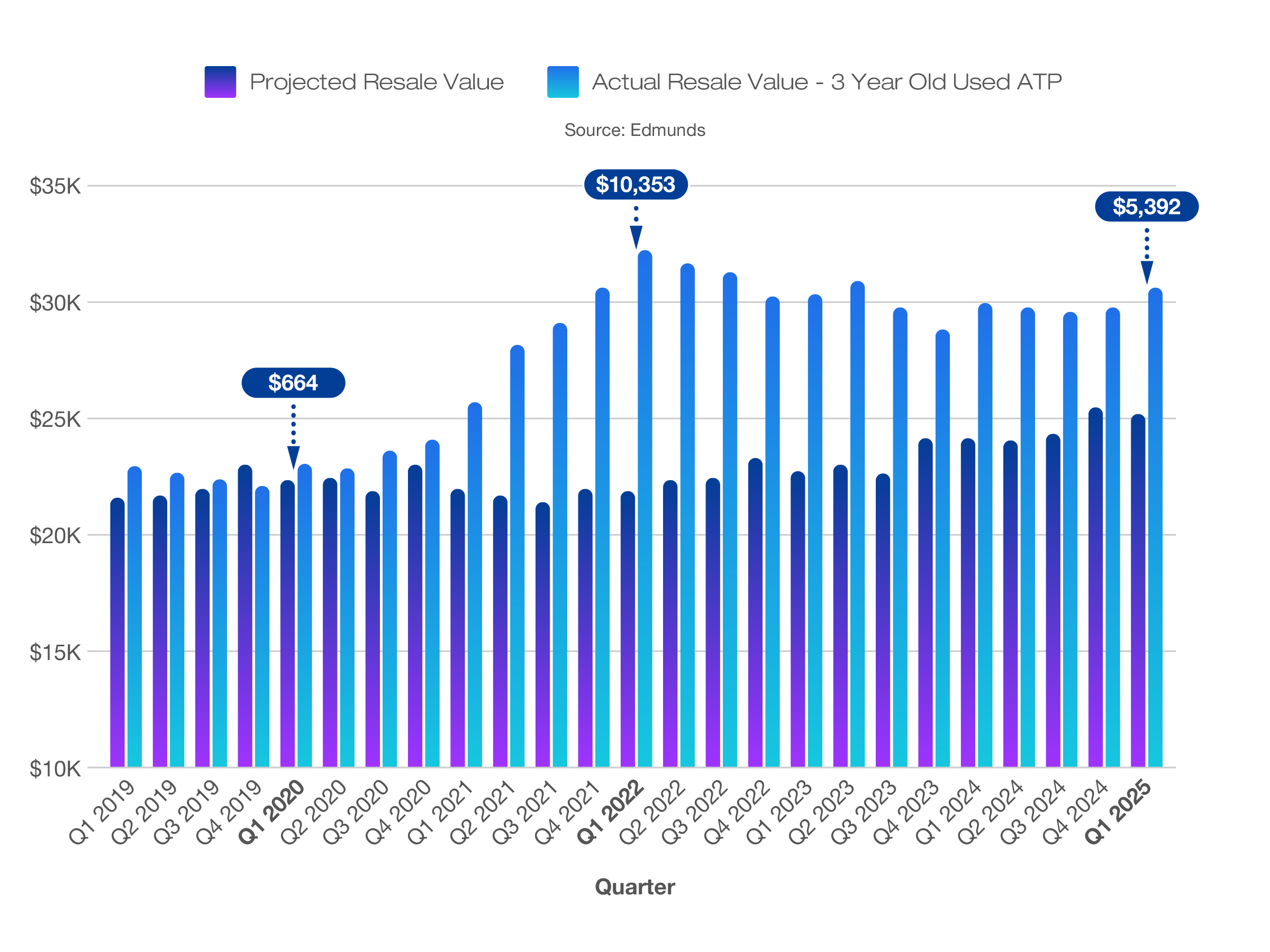

While the pricing gap between new and used vehicles is beginning to narrow, another gap is poised to widen: the one between projected and actual resale values. Predicting resale values is no simple task, as automakers can only forecast and control so many factors related to a vehicle’s estimated residual value three years in the future.

The 2020s in particular have proven just how impactful external influences can be on upending predicted resale values: A wide gap emerged between projected and actual resale values in 2022 as the chip shortage led to significantly lower new-vehicle supply and an accompanying increased demand for near-new used vehicles, driving up prices of that already coveted segment of the used market.

Now, a similar dynamic may be unfolding. As tariffs threaten to restrict new-vehicle supply and pricing, spillover demand could once again inflate values of used vehicles, particularly for near-new models.

For consumers who purchased or leased vehicles in the early 2020s, history may repeat itself. Elevated resale values could offer an unexpected opportunity to exit a regretted purchase with fewer financial consequences or even offset rising costs on their next vehicle.

Tariffs create uneven resale value surprises for 3-year-old vehicles

Difference in Predicted vs. Current ATP

Country of origin* | Original MSRP | Predicted 3-year-old ATP | Current 3-year-old ATP | Difference in predicted vs. current ATP |

|---|---|---|---|---|

| United States | $45,346 | $26,719 | $33,572 | $6,853 |

| Mexico | $34,646 | $20,471 | $26,899 | $6,428 |

| Japan | $35,910 | $22,059 | $28,821 | $6,762 |

| Canada | $35,762 | $21,671 | $29,431 | $7,760 |

| South Korea | $32,352 | $18,733 | $22,778 | $4,045 |

| Germany | $71,307 | $39,470 | $43,769 | $4,299 |

*Chart is sorted by the largest share of new vehicles sold by country of build origin, with the U.S. representing the highest share.

While resale values for today’s 3-year-old vehicles are higher than originally expected across the board, differences in tariff levels by country and the wide range of automaker pricing strategies are likely to create further discrepancies between projected and actual values. As most automakers face tariff-related pricing or supply challenges, more returning car shoppers may see a surprising boost in the value of a trade-in, especially if they have their eyes set on a model unaffected by tariffs.

Edmunds says

If there’s one auto industry lesson learned from the COVID era, it’s that supply-side challenges aren’t to be taken lightly. With tariffs serving as another potential new-vehicle supply inhibitor, Q1 2025 presented warning signs of looming supply issues ahead for the used market, giving us a reason to look back at the early 2020s as a historical precedent and a likely guide to the complications ahead.

Unlike the universal impact of the chip shortage, however, tariffs will be much more targeted, causing uneven disruptions.

For shoppers with trade-ins, country of assembly — usually a nonfactor — now plays an unexpected and potentially significant factor in a vehicle’s resale value. It’s a good idea to get trade-in offers from multiple dealerships, especially if your vehicle was leased in lower volumes and is now built overseas.

For dealers, these same used vehicles will be critical to offset shortfalls in new vehicle inventory and bolster certified pre-owned offerings. Rethinking your supply management strategies will be essential to navigate the market turbulence ahead.

by

by  edited by

edited by