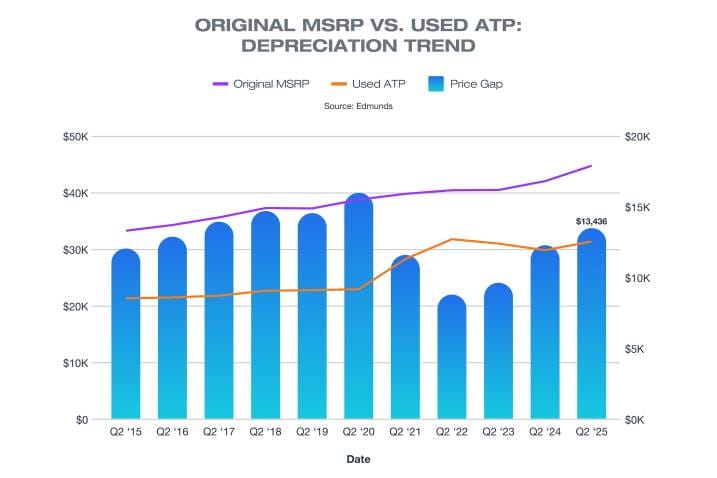

- In Q2 2025 the ATP for 3-year-old vehicles was $31,216, just shy of the all-time record of $31,628 set in Q2 2022.

- The biggest difference: in 2022, those cars originally cost about $40,314 new, compared to $44,651 today — a nearly $5,000 jump that makes used cars a better deal than during the pandemic peak.

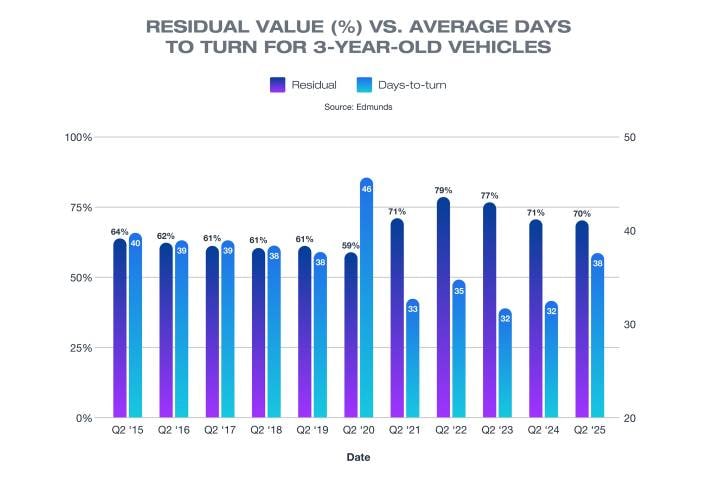

- 3-year-old used cars sat on dealer lots for 38 days on average, signaling softer residual values.

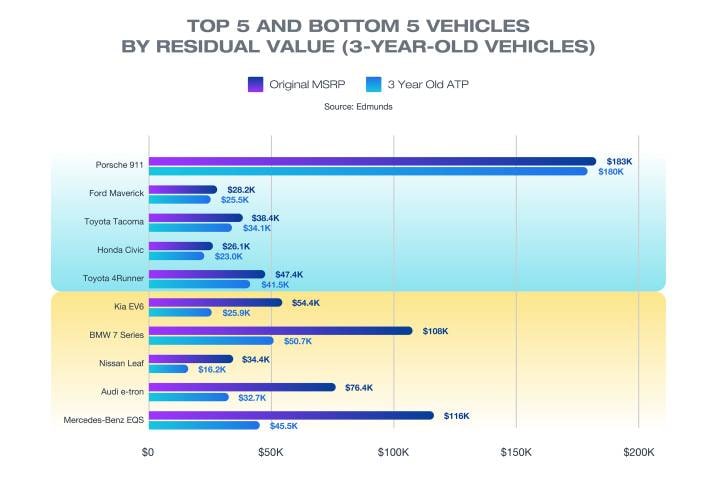

- The steepest discounts were found on models that started with the highest sticker prices.

$30K for a Used Car? Here’s Why That’s Actually a Bargain in 2025

Edmunds data shows 3-year-old used car prices remain near historic highs in Q2 2025

The used market is entering a new phase: Fewer near-new vehicles are available, and those that do make it to dealer lots started with historically high MSRPs. While average transaction prices (ATPs) for 3-year-old vehicles are trending above what many consumers may expect, their value proposition is shifting. Compared to both today’s new car prices and what these vehicles originally sold for, used cars now look like a smarter deal than they have in years.

The state of the used vehicle market in Q2 2025

The ATP for 3-year-old used vehicles increased by 5.2% year-over-year in Q2 2025 to $31,216, up from $29,685 in Q2 2024. At the same time, these vehicles took longer to sell: The average days to turn, or the number of days a vehicle sits on a dealer lot before selling, climbed to 38 days. That's six days slower than a year ago and the highest second-quarter days to turn Edmunds has on record since Q2 2019 (excluding Q2 2020 due to the economic shutdown).

This slowdown is expected as higher-priced used vehicles tend to linger while shoppers hunt for value in lower-priced options. But perceptions of value may shift as the used market increasingly reflects vehicles that were sold new at much higher prices than in years past.

Context matters: Factoring in original MSRP reveals just how much more value buyers are getting today

In 2022, new-car shoppers paid an average MSRP of $46,274, up $3,084 from the prior year and the largest year-over-year increase Edmunds has on record. Now, those vehicles are entering the used market. For shoppers who compare today's used prices to what these cars originally cost, the deals look better than they have since 2020.

Residual values begin to normalize as selling pace stabilizes

Last quarter, we began to see that residual values were stronger than predicted for vehicles coming off-lease from three years ago. While those residuals remain above expectations, they're starting to inch downward.

Overcoming today's higher prices will remain a challenge for shoppers used to pre-pandemic values, but the selling pace is showing signs of stabilization. In Q2 2025, the average days to turn reached 38 days — the highest second-quarter average since 2019. That’s slightly faster than historic norms: During Q2 of 2015-2019, similarly priced vehicles in the $28-$32K range typically sat on lots for about 42 days before selling.

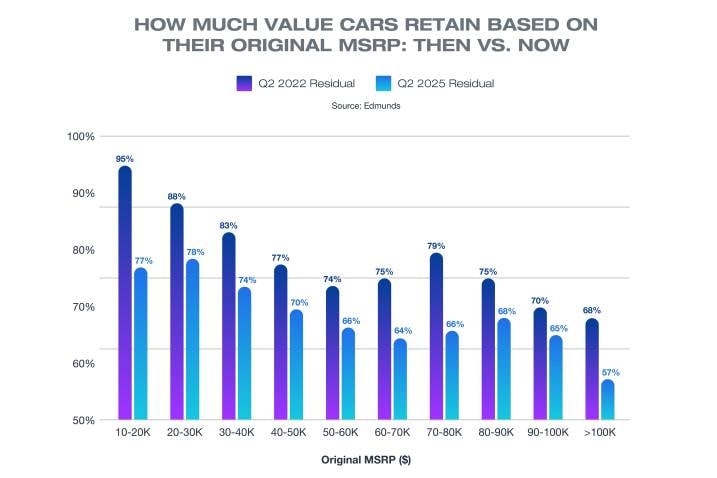

The higher the price, the harder the fall

Three years ago, residual values were shattering records, and many lower-priced vehicles were selling for amounts shockingly close to their original MSRPs. Today, that trend is mostly over. As the market adjusts, residual values are falling across the board — and the biggest drops are hitting vehicles that originally carried the highest price tags.

For buyers, that means opportunity. In Q2 2025, vehicles that originally cost more than $100,000 retained just 57% of their value, compared to 68% three years ago. Models originally priced in the $50K–$60K range now hold 66%, compared to 74% in 2022. Meanwhile, vehicles with lower original MSRPs remain more insulated, with vehicles originally priced between $10,000 and $20,000 still holding 77% of their value in Q2 2025, down from 95% in Q2 2022.

Your deals may vary

Overall trends tell a clear story, but some vehicles still defy expectations. Take the iconic Porsche 911: Three years later, it's selling for nearly the same price as new — a rare feat for a vehicle that started with such a high MSRP.

On the flip side, models like the Nissan Leaf have taken a hit. Originally priced at a budget-friendly $35,000, it now sells for less than half that amount. The shift is driven in part by the steep depreciation we're seeing in the used EV market, where resale values have dropped more sharply than for most segments.

Edmunds says

At first glance, many used vehicles appear to be very expensive, but when you factor in their original MSRPs, their value becomes clearer. These deals aren’t universal since off-lease supply remains tight, but downward pressure on used pricing will likely continue. Looking forward, as automakers continue to apply incentives to move new inventory while attempting to absorb as much of the tariff impact as possible, the used market is expected to soften further.

by

by  edited by

edited by