- New survey highlights a notable disconnect between car shopper price expectations vs. current new and used vehicle average transaction prices, APRs.

- 73% of consumers report that they’ve held off purchasing a new vehicle because of elevated prices.

- More than half of consumers said they plan on working more hours or taking on a new job to afford their next vehicle purchase.

- Findings resulted from the latest car shopper sentiment survey conducted by Edmunds in August 2024.

New Research from Edmunds: Affordability Concerns Among American Car Shoppers Aren’t Going Away Anytime Soon

Edmunds survey results showcase how price expectations for new and used vehicles clash with market realities

New and used vehicle prices may have cooled from scorching levels thanks to improved new vehicle inventory and increased incentives over the past year, but new research from Edmunds reveals that affordability concerns among American car shoppers aren’t going away anytime soon.

Car shoppers hit by elevated prices, near-record interest rates and limited incentives

The average trade-in age for a new vehicle is approximately six years according to Edmunds data, which means a significant number of car shoppers returning to showrooms this year last purchased a car in 2018. Perhaps not so shockingly, much has changed for car buyers since then. In pre-pandemic times, the car shopping landscape was far more buyer-friendly: Automakers were battling inventory glut with generous incentives, interest rates were near historic lows, and average transaction prices were hovering around $35,000. This means that consumers are likely coming back to the market with skewed perceptions of affordability based on their last car shopping experiences.

The latest "Car Shopper Expectations vs. Market Realities" report from Edmunds (see the last, EV-focused version of the report from earlier this year)¹ offers a glimpse into just how skewed those perceptions are, and the results aren’t pretty. In fact, the majority of respondents have noted that they’ve already held off on buying a new ride due to rough market conditions: More than 73% said they’ve done so due to high vehicle prices and more than 62% due to high interest rates. Consumer expectations are clearly not meshing well with what’s currently in the market — but just how glaring are the discrepancies?

Here’s what new- and used-car shoppers are saying they want in their next vehicle, and how that stacks up against what shoppers are actually signing for on the dotted line:

Nearly half of new-car shoppers want to spend less than $35,000

- What consumers want: Among new-car shoppers surveyed by Edmunds, 48% said they’d like to spend $35,000 or less on their next vehicle. 14% said they’d like to spend $20,000 or less on their next vehicle.

- The market reality: According to Edmunds data, the average transaction price for a new vehicle was $47,716 in July 2024, and there were nearly zero new vehicle transactions under the $20,000 mark.

Another disconnect is the discrepancy in the $40K-$60K price range between survey takers and transaction data. Given transaction prices were $12,000 less six years ago, many consumers are simply unaware how many new vehicles have shifted into this price range due to not just inflation but added features, technology and, in many cases, increased size.

More than a third of new-car shoppers are targeting interest rates between 0 and 3%

- What consumers want: Among respondents surveyed by Edmunds, 75% said that the highest acceptable interest rate for a new vehicle purchase was between 0.1% and 6%, with 37% of consumers saying they’d accept an interest rate between 0 and 3%, and 11% of consumers saying they’d accept an interest rate between 0 and 1%.

- The market reality: 60% of new-car buyers financed their vehicles at an APR between 4% and 9%. The average annual percentage rate (APR) for all financed new vehicle purchases in July 2024 was 7.1%. Zero percent financing made up just 4% of all new financed purchases in July 2024.

50% of used-car shoppers want to pay $15,000 or less for their next vehicle

- What consumers want: Among prospective used-car buyers surveyed by Edmunds, 64% said they’d like to spend less than $20,000 on their next vehicle, 50% said they’d like to spend $15,000 or less, and 27% said they’d like to spend $10,000 or less on their next vehicle.

- The market reality: In July 2024, just 5% of all used vehicle transactions were $10,000 or less. The average transaction price for all used vehicles sold in July 2024 was $26,936.

3 out of 4 used-car shoppers are targeting an interest rate between 0 and 5%

- What consumers want: Among respondents surveyed by Edmunds, 76% said the highest interest rate that they’d be willing to accept for a used vehicle purchase was between 0 and 4.99%.

- The market reality: 6 out of 10 car buyers who financed a used vehicle purchase agreed to an interest rate between 6% and 11%. In July, the average APR for all used finance purchases was 11.4%.

Consumers are planning on making big sacrifices to buy their next vehicle

Affordability challenges are already manifesting in new ways for car shoppers:

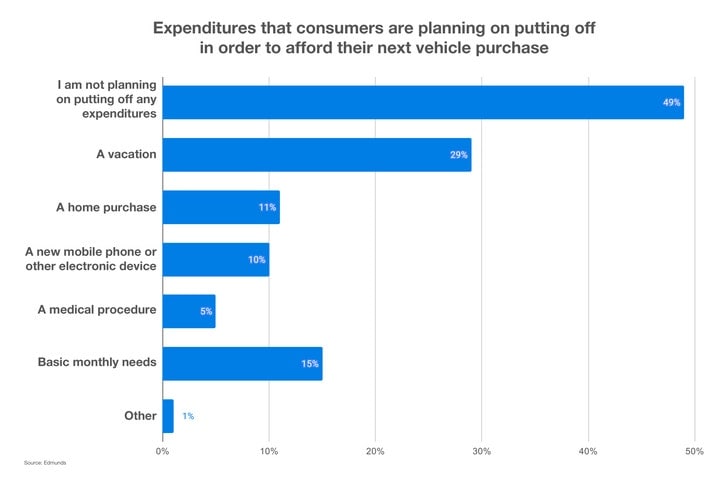

- More than half of survey respondents noted that they were planning on putting off other expenditures in order to afford a vehicle, with 29% saying they were deferring a vacation, 15% basic monthly needs, and 5% medical procedures.

- In response to a separate question, 54% of survey respondents said that they were planning on working more hours and/or taking on an additional job in order to afford their next vehicle.

¹ Edmunds’ data for this report is based on a consumer sentiment survey conducted in August 2024 among car shoppers who have purchased a vehicle previously and have indicated they are planning on purchasing a vehicle in the next 12 months

Edmunds says

Even as the new and used vehicle markets continue to normalize, car shoppers are still facing historically harsh purchasing conditions and those returning to showrooms for the first time in years are likely going to experience major sticker shock. In response, consumers are likely being forced into making trade-offs such as selecting a different brand of vehicle, an older vehicle, or a different-sized vehicle unless they allocate more to their vehicle budget, which isn’t always feasible.

The good news for the auto industry is that many consumers seem aware of these challenges as 65% of respondents said “[their current] car purchase seems more challenging than [their] previous one[s].” But it’s critical for automakers and dealers to know the perception gap exists in order to offer a level of compassion for customers. After all, these are people making real sacrifices in order to afford a vehicle, which is making the car shopping process more stressful than ever.

by

by  edited by

edited by