- New survey highlights a significant disconnect between car shopper preferences and current EV market offerings.

- The findings resulted from a new 2024 EV sentiment survey conducted by Edmunds.

- Analysts say unmet expectations among EV shoppers reflect broader industry challenges on the path to electrification.

Unplugged: Consumer Expectations of EVs Are Clashing With Market Realities

New survey results highlight disparities that amplify EV adoption hurdles as growth rate slows

Supply chain disruptions, EV battery longevity concerns, consumer anxiety about range, and charging infrastructure frustrations have hindered the auto industry’s push to pure electricity over the past few years. Now, new consumer survey results from Edmunds on consideration of electric vehicles illustrate a significant mismatch between car shopper preferences and the realities of today's EV market that could be reflective of current market challenges.

According to the 2024 Edmunds EV Sentiment Survey1, there are sizable gaps between what consumers say are critical EV purchase considerations — namely price, brand trust, vehicle body type and driving range — and the actual vehicles available for purchase.

Sales of EVs rose in 2023 to 6.9% new vehicle market share, up from 5.2% in 2022. But Edmunds analysts have predicted that the rate of growth will slow through 2024, increasing to just 8% market share.

Here are the biggest differentials in consumer expectations compared to market realities.

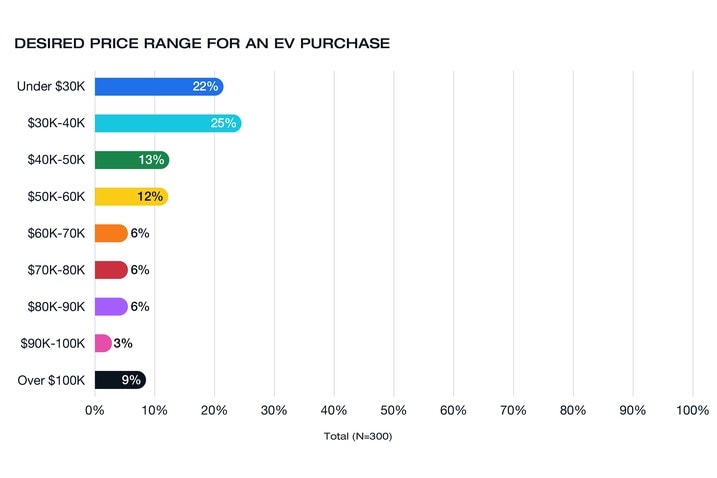

EV shoppers are seeking prices far below current EV costs

- What consumers want: Among EV intenders2 surveyed by Edmunds, 47% say they are seeking an EV purchase below $40,000, and 22% are interested in EVs priced below the $30,000 threshold.

- The market reality: Today, there are no new EVs with an average MSRP below $30,000, and there are only four below the $40,000 mark (Mini Hardtop 2 Door, Nissan Leaf, Fiat 500e and Hyundai Kona Electric). According to Edmunds data, in 2023, the average transaction price of an electric vehicle was $61,702, while all other vehicles stood at $47,450. It’s worth noting that the consumers who are most comfortable with the idea of purchasing a new EV might also not be in a financial position to afford one. Edmunds survey data reveals that 90% of 18- to 24-year-olds say they are open to an EV as their next purchase, and 83% of 24- to 34-year-olds say they are interested as well.

EV shoppers want cars and SUVs, not electric pickups

- What consumers want (or don’t want): Among existing vehicle owners, drivers of pickups are least compelled to consider an EV for their next purchase, with 39% saying they would not consider one. Among all survey respondents interested in an EV purchase, 43% are interested in a car purchase, 42% would consider an SUV/crossover and only 10% would consider a truck.

- The market reality: The electric truck market appears bloated: Rivian R1T, Ford F-150 Lightning, GMC Hummer EV, Tesla Cybertruck, with possibly Chevrolet Silverado EV, GMC Sierra EV and Ram 1500 Rev arriving in the not-so-distant future. It's not surprising that the Detroit automakers moved swiftly to protect their top money-making products from the threat of EV startups, but at least for now it appears this fear was unwarranted as EV pickup trucks are still largely niche products with a limited consumer base.

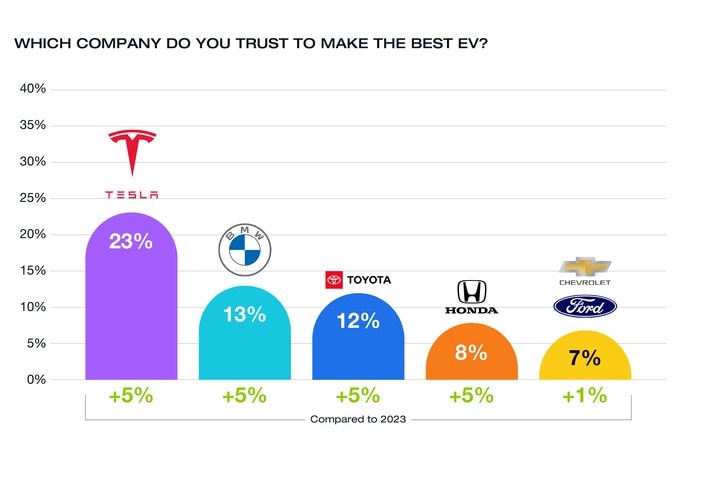

Some brands that EV shoppers trust the most do not currently produce EVs in volume

- What consumers want: Edmunds survey results reveal that Toyota and Honda rank third and fourth, respectively, among the brands that consumers say they trust most to make the best EV. Tesla, still with over 50% market share in the U.S., is the most trusted automaker according to survey results, with BMW (second), Chevrolet and Ford rounding out the top six.

- The market reality: Toyota has just one EV on the market in the U.S., while Honda begins selling its first pure electric this month. As these automakers ride a wave of success with their hybrid products, they have earned decades-long reputations for quality, instilling consumer trust in new technology. On the flip side, even though Hyundai and Kia have generated solid EV market shares with strong-performing new products, they aren’t receiving the same recognition by consumers in our survey.

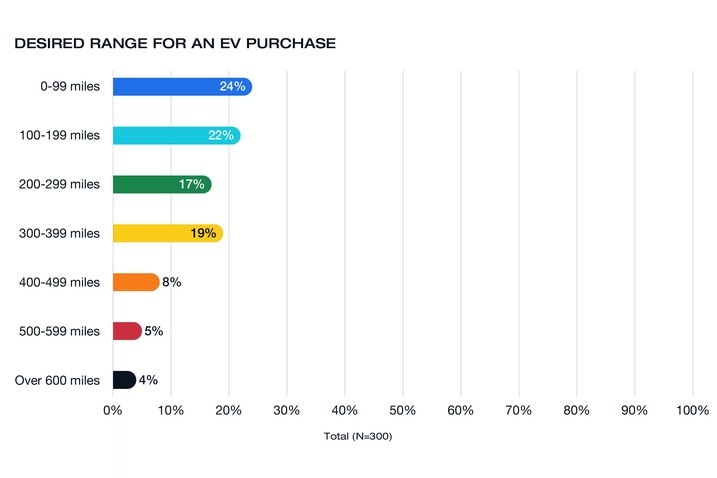

EV shopper range expectations are met, but consumer preferences also imply a knowledge gap

- What consumers want: When posed with a question of their desired range for an EV they would consider purchasing, 46% of consumers said they were comfortable with 200 miles or less. 24% said they were comfortable with 99 miles or less.

- The market reality: According to results from the Edmunds EV Range Test, 200 miles is a target easily met by the vast majority of EV models on the market today. But the significant percentage of respondents who indicated they were comfortable with a range below 100 miles signals a potential knowledge gap surrounding realistic range expectations.

1The 2024 EV sentiment survey was conducted by Edmunds among U.S. car shoppers in January 2024

2Survey respondents who indicated they were considering an EV for their next vehicle purchase

Edmunds says

The electric vehicle market is growing, but consumers have enough reservations about the current options and charging infrastructure challenges to limit more significant growth in the short term. And beyond these hurdles, EVs still struggle to captivate the mainstream market; new technologies typically undergo a gradual acceptance curve before more than just early adopters jump in. In the meantime, some automakers are pumping up hybrid production and creating plans to add new hybrid options to their lineups, making hybrids a great alternative for shoppers not yet ready to fully plug in.

by

by