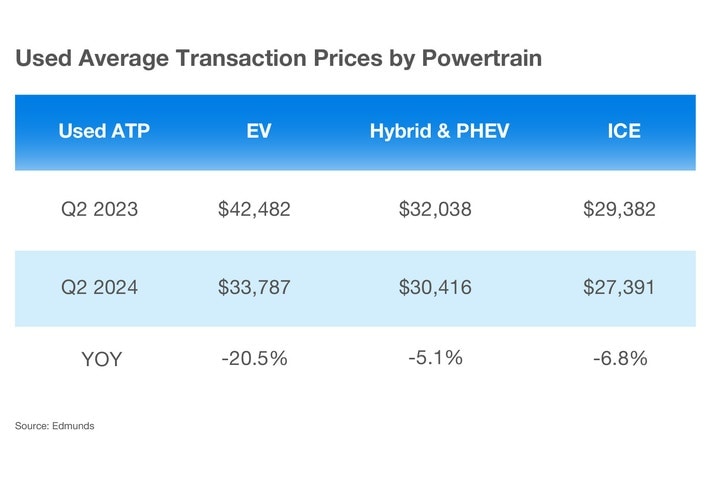

- Used vehicle prices fell 6.8% from Q2 2023, but days to turn for used vehicles stayed relatively flat, indicating stability in the market.

- Used EV values have undergone a major course correction, falling 20.5% year over year from Q2 of 2023 and 38.5% from Q2 2022.

- The average age for a used EV is 2.7 years, trending younger than the industry used-vehicle average of 4.5 years.

Used Vehicle Prices Undergo Major Course Correction in Q2

Used EV values are hit especially hard

Electric vehicles might be considered the transportation of the future, but recent developments in the U.S. market have also made them a readily available secondhand item.

The state of the used vehicle market in Q2 2024

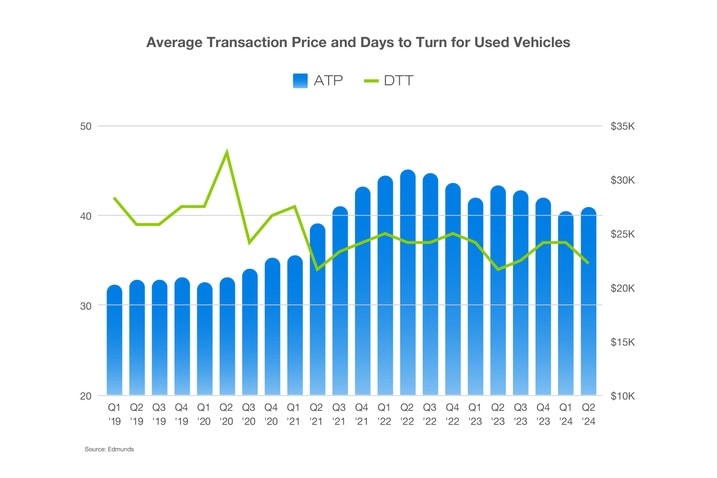

Used vehicle values fell by 6.8% year over year from $29,742 in Q2 2023 to $27,472 in Q2 2024. This decline was paired with a negligible increase in turnover on dealership lots: The average days to turn — the number of days a vehicle sits on a dealership lot before being sold — for used vehicles was 35 days in Q2 2024 compared to 34 days in Q2 2023.

These trends in the used market are a direct reflection of dynamics in the new-car market as inventory levels normalize: The average discount for new vehicles climbed to $1,687 in Q2 2024 compared to $611 in Q2 2023, while the average days to turn for new vehicles increased to 53 days in Q2 2024 compared to 37 days in Q2 2023. A buildup of new vehicles on lots over the past year has been the catalyst for discounts and incentives on aging inventory. As these new car prices trend downward, values of newer used vehicles have correspondingly declined.

Not all used markets are equal

While the used vehicle market overall is performing more predictably in recent quarters, there is one subset of the market that is wreaking havoc on owners seeking to trade in their vehicles as well as sellers aiming to forecast an accurate selling price — used EVs.

This news shouldn't surprise anyone in the automotive industry, as we’ve seen automakers utilize virtually every incentive under the sun to move stale new-EV inventory. With those new-EV price cuts occurring directly as a result of cash incentives and MSRP reductions, as well as heavily subsidized leases that also allow the use of the Inflation Reduction Act tax credit, the trickle-down effect on the used vehicle market has been pronounced. In a recent Edmunds analysis of negative equity trends in the automotive industry, the data showed that EV owners with negative equity owe more money on their loans than owners of internal combustion engine (ICE) vehicles.

A turning point in the used EV market

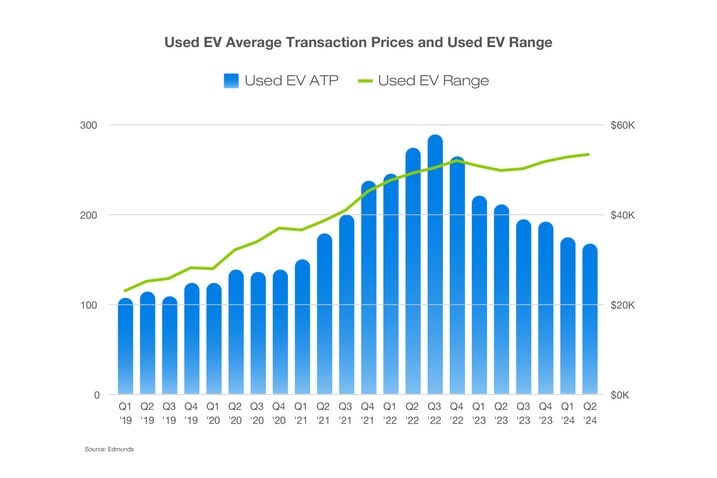

This downward trend in values marks an abrupt turn in the trajectory of the used EV market, which had a runup in prices with the introduction of competitive products. We seem to have reached a point where used EVs values are succumbing to more mainstream market forces.

Used EV transaction prices mirror the broader used market …

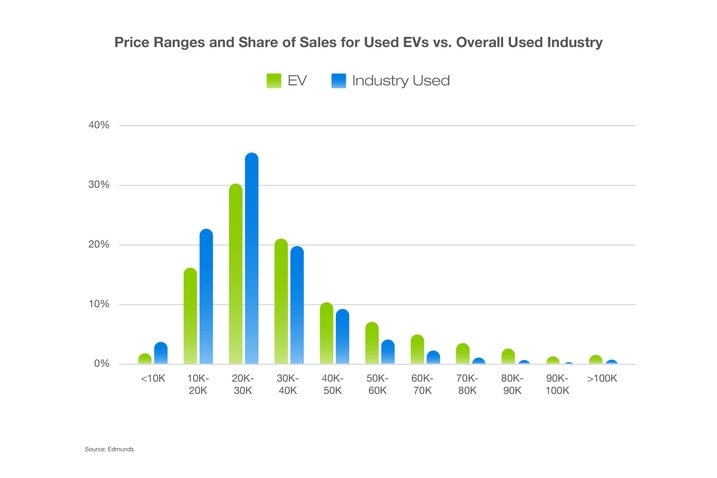

Average prices for used EVs typically command a premium against the overall used market, but a closer look at the highest share of transactions across different price ranges shows that, similar to the broader industry, the bulk of EV sales fall within the $20,000–$30,000 range.

And yet, while the highest volume of sales in the EV market and overall industry come in the same price range, the EV market features a bit of a long tail for transactions occurring at the higher price points. Transactions over $30,000 account for 51.9% of the used EV market, while that figure drops to 38.1% for the overall used market.

But EV sales diverge from the broader market when it comes to age

A typical used car in Q2 2024 was 4.5 years old with 52,478 miles. For used EVs, those figures were 2.7 years old and 29,430 miles. For shoppers willing to consider multiple propulsion types and those in search of the newest used vehicles, the value proposition of these lightly used EVs could be very appealing.

Financed used EVs compete with not only used ICE vehicles but also new vehicle leases

A good value can be seen from many angles, but obtaining the newest vehicle at the lowest price is a clear way to maximize value in a purchase. Although financed used EVs tend to command higher down payments than their ICE counterparts and leased vehicles of any powertrain type, average monthly payments look very similar across both powertrains and leases. Financing a used EV only becomes more of a clear winner when factoring in the average lower vehicle age compared to used ICE vehicles and the equity at the end of a purchase compared to a lease.

The big gamble is that with longer range no longer correlating with higher resale values, what will these EVs be worth by the time the loans are paid off? Even as heavy depreciation has already taken its toll on used EV values, we’re nowhere near the trough of depreciation, especially if the promise of $25K-target-price new EVs becomes a reality.

Edmunds says

Continued predictable used market norms are a welcome sign for 2024. With more easily predictable used vehicle values, buyers and sellers are able to make purchase timing and pricing decisions that should limit remorse. However, the used EV market is still a bit more volatile, which is especially troubling as more automakers struggle to move new EVs without heavy incentives. Even though automakers are reducing production and coming to terms with EVs not commanding as high of a price premium as previously thought, there are more products set to debut at lower price points, which will exacerbate the issue since these new, cheaper EVs will compete with similarly priced used EVs.

With major price reductions hitting the used EV market, many consumers might be asking themselves: Is now a good time to buy a used EV? Although affordable EVs seem to have finally arrived in the form of lightly used versions (which are growing more readily available in the market), the answer is … it depends.

by

by  edited by

edited by