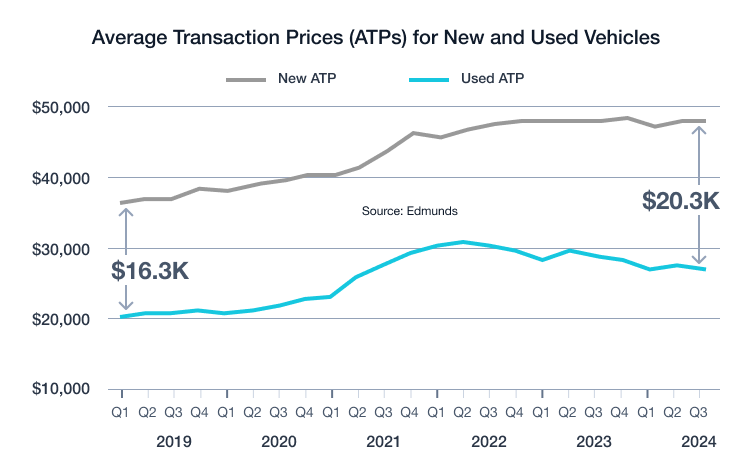

The average price gap between new and used vehicles widened to more than $20,000 for the first time ever, according to Edmunds’ records.

- An August 2024 Edmunds survey1 reveals unrealistic expectations among consumers: 50% of car shoppers prefer a new car, but one in seven new-car shoppers wants to spend $20K or less.

- Many new-car shoppers may not realize their expectations for a purchase may be more realistically met on a used car lot.

Average Price Gap Between New and Used Vehicles Surpasses $20K for the First Time Ever in Q3

New transaction and survey data from Edmunds highlights why many shoppers expecting to buy a new vehicle will likely turn to the used lot for their next deal

As new-vehicle pricing continues its relentless ascent, the used market is looking like a better option for more shoppers.

The state of the used vehicle market in Q3 2024

Used vehicle prices dropped by 6.2% year over year to $27,177 on average, down from $28,960 in Q3 2023. The falling values are joined by steadiness in turnover at dealerships: The average days to turn — the number of days a vehicle sits on a dealer lot before a sale — for used vehicles was 36 days, up one day from a year prior.

Normalization trends in the used market are correlated with new-vehicle market forces as brand-new inventory has risen from pandemic-era lows. Now, top-down pressure from slowing new-vehicle sales has resulted in more discounts trickling down to the newest used vehicles.

From the vantage point of in-market shoppers, the falling used vehicle prices are an encouraging sign. But for those getting ready to begin their search after years away from the market, the latest trends won’t offer much relief as used prices are still up 31.4% from Q3 2019 ($20,683).

New vs. used prices grow further apart than ever

For consumers returning to the market, the crucial decision of whether to buy new or used takes center stage. For those on the fence, it will be helpful to know that the difference between new vs. used vehicle pricing widened to more than $20K in Q3, representing the widest margin ever between the two markets and likely facilitating quicker decision making2. On average, a new vehicle transacted for $47,542 in Q3, compared to $27,177 for a used car — a difference of $20,365.

The average discount for new vehicles climbed to $1,744 in Q3 2024 compared to $828 in Q3 2023. That’s an encouraging trend for new-car shoppers, but not enough to reverse increasing lot times as new vehicles took 57 days to turn in Q3 2024 — the highest figure Edmunds has tracked since Q1 2021’s 58 days to turn.

With inconsistent discounts on new inventory, consumers with fond memories of deeper discounts and widespread financing deals from their pre-COVID era new-vehicle purchases are likely to shy away from that market this time around and instead opt for a used car lot with more significant savings to be found.

Shopper expectations on new vs. used prices not aligned with market realities …

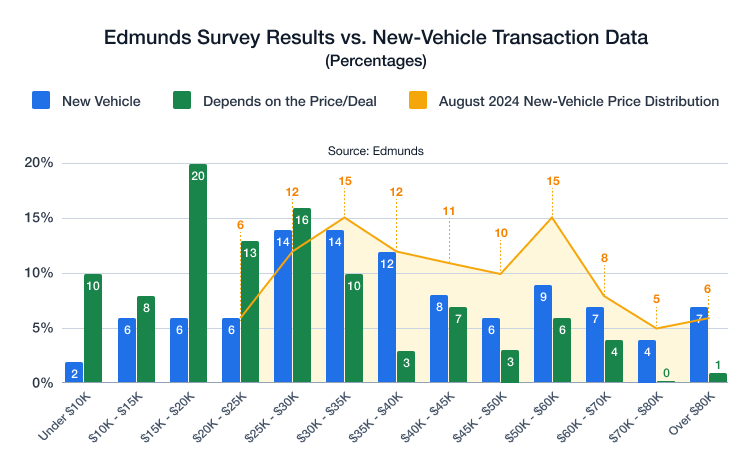

The latest "Car Shopper Expectations vs. Market Realities" report from Edmunds showed that surveyed car shoppers were more interested in new car purchases compared to used, with 49.8% of respondents selecting “New vehicle,” 26.4% choosing “Used vehicle,” and 23.8% opting for “Depends on the price/deal.”

While this data reflects consumer intentions, real-world transaction data from Edmunds shows that even with the best of plans, many who say they prefer a new vehicle or are open to both options depending on the deal are likely to end up with a used car unless they adjust their expectations. At a minimum, 14% of “New vehicle” respondents and 38% of “Depends on the price/deal” respondents will end up with a used vehicle as there are no new vehicles within the $20,000-or-less tier that these respondents said they would be shopping.

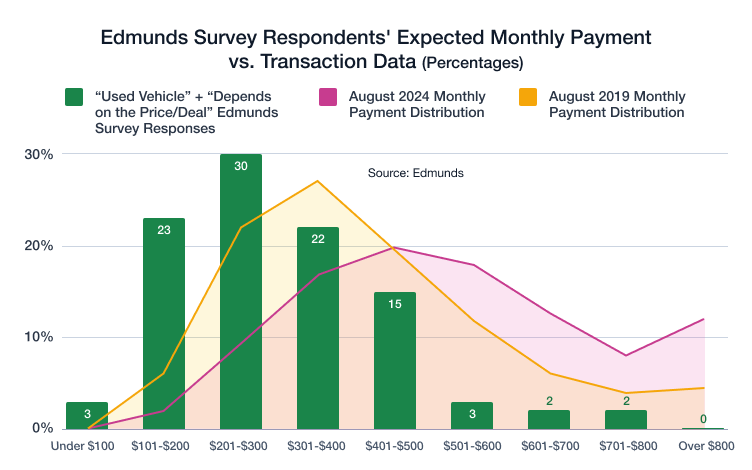

… And their estimated monthly payments need revisiting

Even when consumers are decided on the new vs. used vehicle shopping choice, their assumptions about what their monthly payments will look like do not match up to today’s reality. For respondents that indicated either “Used vehicle” or “Depends on the price/deal,” many are envisioning a monthly payment that is far more reminiscent of 2019 figures: 56% said they intend to make payments of $300 or less. The average monthly payment for a used vehicle in Q3 2024 was $548, compared to $413 in Q3 2019.

Yesterday’s car budget won’t stretch to today’s prices

Edmunds Auto Finance Figures Associated with $200-$300 Used Vehicle Monthly Payments (Averages)

Sale Date | Avg Model Year | Vehicle Age | Mileage | ATP | Down Payment | APR |

|---|---|---|---|---|---|---|

| Q3 2019 | 2015 | 4.4 | 54,730 | $14,446 | $2,808 | 8% |

| Q3 2024 | 2018 | 6.5 | 71,140 | $17,186 | $6,114 | 10.5% |

With the $200-$300 range serving as the lion's share of where “Used vehicle” and “Depends on the price/deal” shoppers indicated they would like to transact, it’s worth investigating why there’s an expectation for monthly costs so far below today’s norms. According to Edmunds data, nearly one in five used transactions fit within the $200-$300 payment window in 2019. Today, that range represents fewer than one in 10 financed deals.

What consumers might find more troubling is the comparison of age and mileage of vehicles selling within the $200-$300 monthly payments bracket: vehicles financed today with monthly payments between $200-$300 are almost 3 years older and have 16,000 more miles driven than 2019 vehicles at that monthly payment threshold. And that’s before factoring in more than double the down payment compared to 2019 figures and APRs now in the double digits.

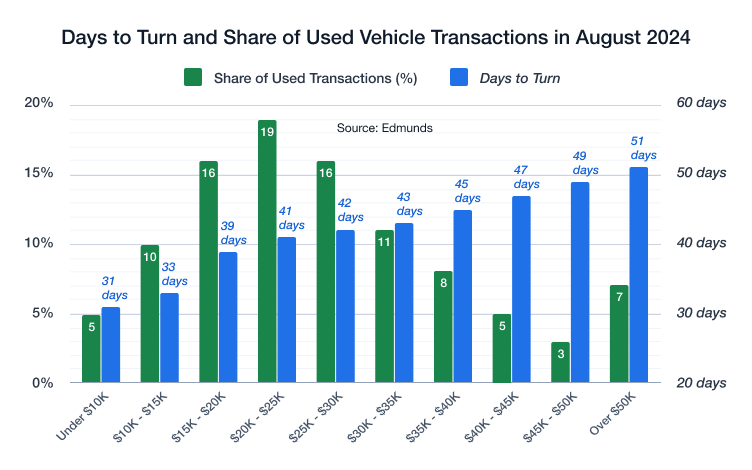

The used car sweet spot

Used-car shoppers are gravitating toward two major price bands. The most competitive category is the sub-$10K bucket, where vehicles are selling at the fastest rate — on average, these vehicles last one month on a lot before being sold. The $15K-$30K range represents another significant purchasing sweet spot, accounting for a share of more than 50% of all used vehicle transactions.

The sub-$10K category caters to first-time buyers, with fewer than one in 10 involving a trade-in for their purchase and an average purchase age of nearly 11.5 years old. The $15K-$30K range covers a wide swath of buying conditions by offering consumers much newer vehicles (4 years old on average) with an average of 50.4K miles. This is also a price point that can absorb priced-out and deal-seeking new-car shoppers.

Edmunds says

As new cars become increasingly more expensive, more shoppers who initially intended to buy new will turn to the used market. However, they still may end up paying more than expected for a newer used vehicle or settling for an older set of wheels.

Whether shopping new or used, buying a vehicle isn’t cheap, making the search process and pricing evaluation more significant than ever. With a fast-changing market, many consumers' expectations no longer match up to current realities. Both new and used car seekers will face situations that differ from their previous purchase experiences, often leading to unexpected compromises.

While the current market is daunting, there is a silver lining for current vehicle owners on the hunt for their next vehicle: the automotive industry’s continuous push for innovation means that nearly any vehicle purchased today, regardless of price or age, will likely offer more features and comfort than a buyer’s previous vehicle ownership experience.

1 Edmunds’ data for this report is based on a consumer sentiment survey conducted in August 2024 among car shoppers who have purchased a vehicle previously and have indicated they are planning on purchasing a vehicle in the next 12 months

2Edmunds data on new vs. used pricing spans back to January 2004

by

by  edited by

edited by