- Record-high prices over the past few years pushed consumers out of the market, resulting in deferred demand.

- Despite improved new-vehicle inventory, volumes aren’t high enough to cause discounting throughout the entire used market.

- Used vehicles on sale are trending older, and these older models aren’t offering the price relief you’d expect.

Surging Demand in Used Car Market Unfazed by Rough Conditions, Fewer Gently Used Vehicles Available

Used car market stays hot due to deferred demand and limited off-lease volume

The push and pull of supply and demand have wreaked havoc on the car market since the early days of the COVID-19 pandemic. Today, supply of new vehicles is on an upward trajectory, but the ramifications of supply chain and microchip shortages continue to linger.

The used car market is still feeling the sting of a volume crunch, where recent wins for shoppers are seen only in the context of pricing that is down from all-time highs.

That new-car shortage from the past few years is now leading to fewer near-new used models for sale, which is creating a cascading negative effect on the makeup of vehicles available through the entire used market, including the lower end.

In the backdrop, shoppers who have patiently waited out the worst of the pricing volatility are now returning to the market with more urgency, propping up still-elevated pricing. According to data from Edmunds’ Insights team, the average days to turn for used vehicles — the number of days a vehicle sits on a dealership lot before being sold — dropped to 34 days in Q2 2023 compared to 39 days in Q2 2019. Combined with economic pressures like spiked interest rates, the used market is as difficult to navigate as ever.

Edmunds analysts dove into the data and collected five major trends in their Q2 2023 Used Vehicle Report. Here’s what they are seeing:

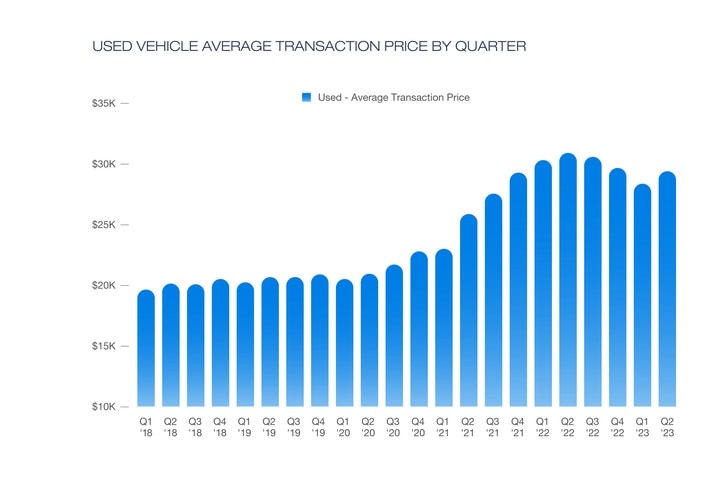

Trend 1: Used vehicle prices have dipped from record levels but remain historically high.

The average transaction price for used vehicles in Q2 2023 was $29,472, a 4.6% downturn compared to last year’s record peak in Q2 of $30,905, but still a steep 46% increase from Q2 2018’s tally of $20,153.

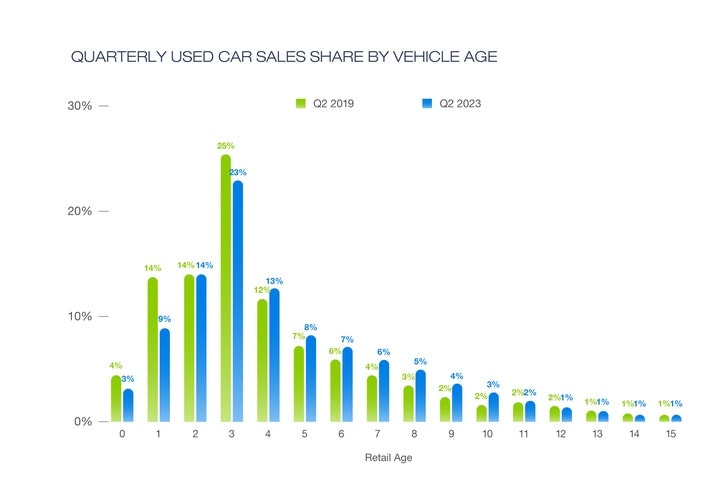

Trend 2: Used vehicles for sale are trending older

Fewer near-new vehicles (3 years old or newer) are on the market due to disruptions in rental car agency replacement purchases and leasing life cycle shifts. In Q2 2019, dealers were stocking a greater percentage of newer used vehicles, with 58% of their sales resulting from 3-year-old or newer used vehicles; in Q2 2023, that figure decreased to 49%.

Trend 3: Higher-mileage vehicles aren’t offering the financial relief they used to

Given the constricted inventory of near-new vehicles, it’s no surprise to see pricing for those vehicles to be higher than prepandemic figures. But Edmunds data reveals that even used vehicles with 100K-150K miles cost 40% more in Q2 2023 compared to Q2 2019, while vehicles with 150K-200K miles are commanding 28% more than in Q2 2019.

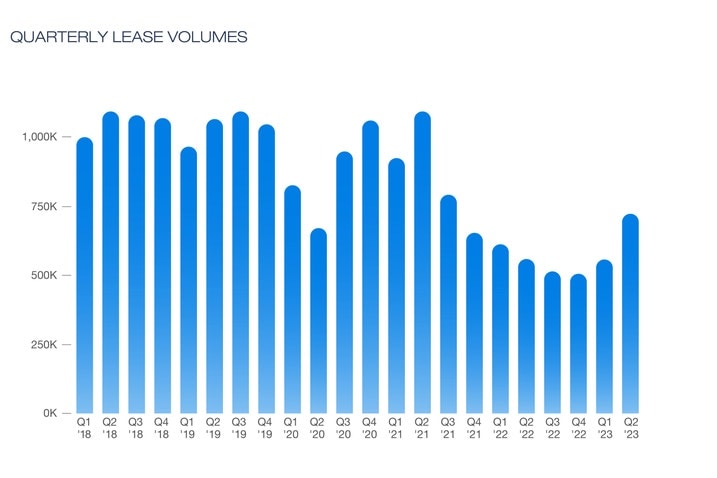

Trend 4: Off-lease is no longer a reliable pipeline for near-new vehicles

According to Edmunds data, nearly 1 in 5 new vehicles are leased in today’s market, down from 1 in 3 just a few years ago. In addition to fewer lease deals more broadly, analysts predict that the pipeline of vehicles returning to the market after a lease is expected to be further constrained moving forward because many automakers' captive finance arms have implemented rules against working with third-party companies for buyouts and early lease terminations.

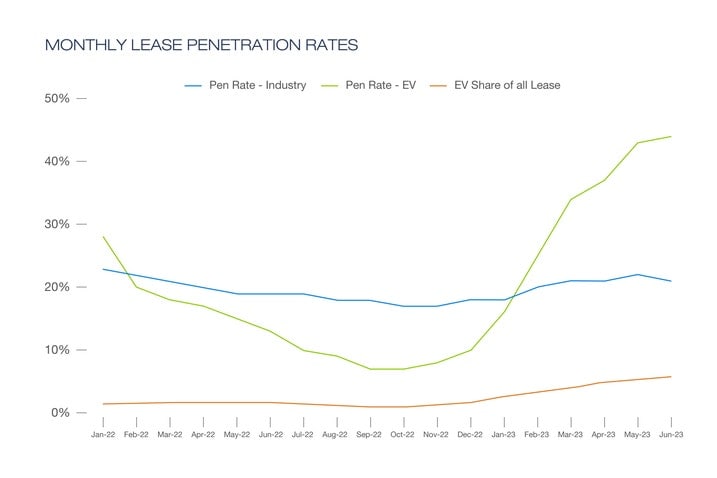

Trend 5: EV market embraces leasing, but benefits for used market still miles away

EV leasing is on the rise, but high average new-vehicle pricing and low volumes relative to the full market will keep their used market values inflated for a number of years. This also means few will dip below the Inflation Reduction Act’s required $25,000 limit for EV tax credit eligibility.

Top tips for used-car shoppers

- Determine your trade-in value: The trade-off to higher used vehicle prices is that your trade-in has more value too. You can get a free vehicle appraisal on sites like Edmunds and track the changes in your car’s value over time with a tool like this one.

- Shoppers in the near-new used market should consider CPO vehicles: For folks with the cash to play with in the near-new market, certified pre-owned (or CPO) vehicles could be the move. An overlooked aspect of CPOs is the potential to qualify for interest rates you’d find in the new car market. CPO buyers also get peace of mind with a built-in vehicle inspection, along with an extended warranty and thousands of dollars saved on interest payments over the life of the loan.

- Timing is everything: Used car prices aren’t expected to fall much in the next one to three months, so it’s best to get serious about your plans to hunt down a new ride if you need reliable transportation in the short term.

Edmunds says

The one constant we can count on in the car market these days seems to be volatility. Factors impacting the used market in particular — namely, inconsistent avenues of supply and broader economic unknowns like 2023’s heightened interest rates — make this a tough market to predict too far into the future. Shoppers that are able to reset expectations on what a good vehicle value looks like and how far their money will take them with respect to vehicle features and mileage will be the ones leaving the used car lot feeling best about their purchase.

Check out the Edmunds Q2 2023 Used Vehicle Report for a closer look at what’s behind these trends.

by

by