Tennessee electric vehicle tax credits, rebates and incentives

Retail Cash

$12,500Maximum RebateRetail Bonus Cash (#11200). Eligible buyers may receive Retail Bonus Cash on select new vehicles. Incentive may be incompatible with certain finance types or other cash programs, based on individual program rules. Take new retail delivery from dealer stock by 07/08/2024. Residency restrictions apply. See dealer for qualifications and complete details.Customer Cash

$10,000Maximum RebateRetail customers may be eligible for cash incentive. Incentive may not be combined with LFS Lease or Special APR financing. Residency restrictions apply.Bonus Cash

$7,500Maximum RebateEligible customers may receive cash incentive. Cash incentive may be incompatible with certain finance types or other cash programs, based on individual program rules. Residency restrictions apply.Clean Vehicle Offer

$7,500Maximum RebateNot available with special financing, lease and some other offers. See dealer for details.Clean Vehicle Offer

$7,500Maximum RebateNot available with special financing, lease and some other offers. See dealer for details.Customer Cash

$7,500Maximum RebateRetail customers may be eligible for cash incentive. Incentive may not be combined with KIA Motor Finance Lease or Special APR financing. Residency restrictions apply.Federal Credit

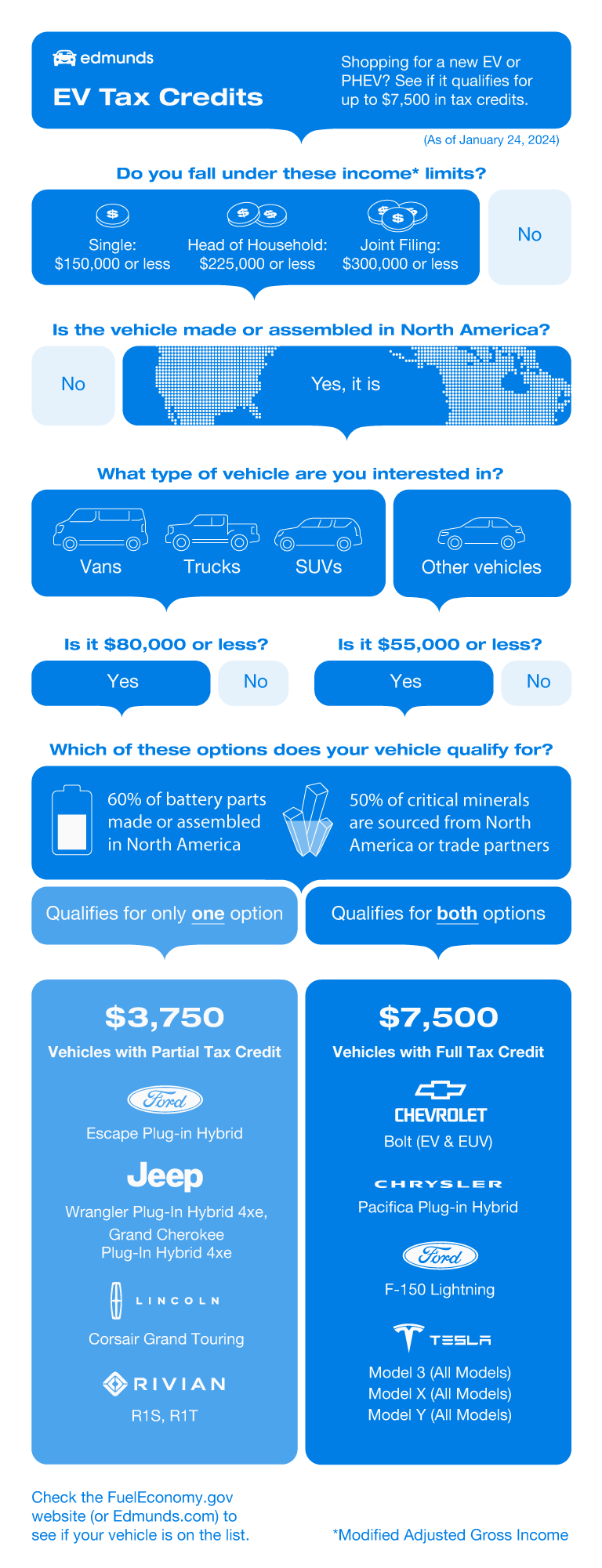

$7,500Maximum RebateUnder the Inflation Reduction Act of 2022, the Internal Revenue Service (IRS) offers taxpayers a Clean Vehicle Tax Credit of $3,750 or $7,500 depending on model eligibility for the purchase of a new plug-in electric vehicle. Beginning January 1, 2024, Clean Vehicle Tax Credits may be initiated and approved at the point of sale at participating dealerships registered with the IRS. Dealers will be responsible for submitting Clean Vehicle Tax Credit information to the IRS. Buyers are advised to obtain a copy of an IRS "time of sale" report, confirming it was submitted successfully by the dealer. To be eligible:

- A vehicle must have undergone final assembly in North America (the United States and Puerto Rico, Canada, or Mexico).

- Critical mineral and battery component requirements determine credit amount.

- Maximum MSRP of $55,000 for cars and $80,000 for SUVs/trucks/vans.

- Income eligibility applies depending on modified adjusted gross income (AGI) and tax filing status.

To learn more, visit https://www.irs.gov/credits-deductions/credits-for-new-clean-vehicles-purchased-in-2023-or-after

Retail Cash

$7,500Maximum RebateGenesis Retail Bonus Cash for customer that purchase a new Genesis model. Not compatible with subvented lease or APR programs.Customer Bonus Cash

$7,000Maximum RebateCustomers purchasing select Volkswagen models may be eligible for bonus cash incentive. Offer not applicable to purchase or lease using VWFS. See your Volkswagen retailer for complete details.Military Offer

$5,000Maximum RebateSpecial BMW Incentive offer is valid at any authorized BMW Center in the United States. Incentive offer is subject to change without prior notice. BMW of North America, LLC requires presentation of a photo ID, your BMW Manufacturer Certificate with a unique Customer ID, and Offer Code. One incentive per customer, per offer code, per calendar year for new BMW vehicles. Eligible military member must be the purchaser. See your authorized BMW Center for complete program details.Affiliations, Clubs or Groups Offer

$3,000Maximum RebateMembers of Costco may receive additional support on eligible vehicles purchased or leased.Bonus Cash

$3,000Maximum RebateRetail Bonus Cash (#11198). Eligible buyers may receive Retail Bonus Cash on select new vehicles. Incentive may be incompatible with certain finance types or other cash programs, based on individual program rules. Take new retail delivery from dealer stock by 07/08/2024. Residency restrictions apply. See dealer for qualifications and complete details.Complimentary Charging Offer

$2,600Maximum RebateBMW of North America offers customers, who purchase or lease a new BMW i7 from participating dealers, a complimentary Level 2 BMW Wallbox EV charger worth $600 MSRP and a charger installation credit of up to $2,000 for installations through QMerit. If the BMW dealership does not have the BMW Wallbox in inventory, a future delivery will be arranged. For the installation credit, must be scheduled through Qmerit and installation completed within 90 days of vehicle lease or purchase contract date. Qmerit will only bill the customer if the installation amount exceeds $2,000. Installations at or below this amount are no cost to customer. Offer is non-transferable. See your participating dealer for details.Loyalty Offer

$2,500Maximum RebateCurrent Chevrolet Bolt EV or Bolt EUV owners/lessees qualify for this loyalty offer. Customer is not required to terminate their qualifying current lease or trade in their qualifying vehicle. Cannot be combined with conquest offers. Proof of qualifying vehicle ownership or lease is required. See dealer for details.Select Inventory Offer

$2,000Maximum RebateRetail Order Bonus Cash (#11072). Eligible buyers may receive Retail Order Bonus Cash on select new vehicles. Incentive may be incompatible with certain finance types or other cash programs, based on individual program rules. Take new retail delivery from dealer stock by 07/08/2024. Residency restrictions apply. See dealer for qualifications and complete details.Adaptive Equipment Allowance

$1,500Maximum RebateAudi is pleased to announce that we are continuing the Mobility Assistance Program for handicap hand controls that are installed on any qualifying Audi model. We will also consider other types of handicap assists (or other approved handicap assistance devices.) to anyone who purchases or leases a new Audi or CPO Audi vehicle. All exception requests from dealers should be made directly to mobilityassistance@audi.com

2023 Ford F-150 Lightning

$16,000Vehicle Rebates+ more qualifying rebates2024 Chevrolet Blazer EV

$15,000Vehicle Rebates+ more qualifying rebates2024 Cadillac LYRIQ

$15,000Vehicle Rebates+ more qualifying rebates2024 Volkswagen ID.4

$14,500Vehicle Rebates+ more qualifying rebates2023 Volkswagen ID.4

$13,000Vehicle Rebates+ more qualifying rebates2024 Chevrolet Equinox EV

$7,500Vehicle Rebates+ more qualifying rebates2024 Ford F-150 Lightning

$7,500Vehicle Rebates+ more qualifying rebates2023 Lexus RZ 450e

$10,000Vehicle Rebates2023 Ford E-Transit Cargo Van

$7,500Vehicle Rebates+ more qualifying rebates2023 Chevrolet Bolt EUV

$7,500Vehicle Rebates+ more qualifying rebates2023 Chevrolet Bolt EV

$7,500Vehicle Rebates+ more qualifying rebates2024 Kia EV9

$7,500Vehicle Rebates+ more qualifying rebates2023 Cadillac LYRIQ

$7,500Vehicle Rebates+ more qualifying rebates2023 Kia EV6

$7,500Vehicle Rebates+ more qualifying rebates2024 Kia EV6

$7,500Vehicle Rebates+ more qualifying rebates

Federal EV Tax Credits Overview

Federal EV Tax Credit Incentive #1: North American Final Assembly

Federal EV Tax Credit Incentive #2: Origin of Critical Battery Minerals ($3,750 Tax Credit)

Federal EV Tax Credit Incentive #3: Origin of Battery Components ($3,750 Tax Credit)

Federal EV Tax Credit Incentive #4: No Involvement by Blacklisted Countries After 2023

Federal EV Tax Credit Incentive #5: Price Limits

Federal EV Tax Credit Incentive #6: Buyer Income Limits

FAQ

EV Tax Credits Vehicle Eligibility

More EV News Articles

- Electric Vehicle Tax Credits: What You Need to KnowRonald Montoya•09/08/2022

- Best Electric Cars of 2022 and 2023Edmunds

- Edmunds' EV Buying GuideEdmunds•05/05/2022

- Cheapest Electric CarsEdmunds•03/22/2022

- The True Cost of Powering an Electric CarEdmunds•03/29/2022

- Home EV Charging 101Jonathan Elfalan•04/21/2021

- 2024 Sierra EV Denali Edition 1 Gets Improved Range and Lower PriceChris Bruce•04/17/2024

- The 2025 Lotus Eletre Is Big, Not Pretty, and Costs Over $100KConnor Hoffman•04/16/2024

- 2024 Chevrolet Silverado EV RST Is Coming With Lower Price and More RangeChris Bruce•04/04/2024

- Early Chevy Blazer EV Buyers Are Eligible to Get Some Money BackSteven Ewing•03/20/2024

- These Are the Rivian R3's Raddest FeaturesNick Yekikian•03/08/2024