Tennessee electric vehicle tax credits, rebates and incentives

Retail Cash

$12,500Maximum RebateRetail Bonus Cash (#11200). Eligible buyers may receive Retail Bonus Cash on select new vehicles. Incentive may be incompatible with certain finance types or other cash programs, based on individual program rules. Take new retail delivery from dealer stock by 07/08/2024. Residency restrictions apply. See dealer for qualifications and complete details.Customer Bonus Cash

$10,000Maximum RebateCustomers purchasing select Volkswagen models may be eligible for bonus cash incentive. See your Volkswagen retailer for complete details.Sales Event Offer

$10,000Maximum RebateSpring Purchase Allowance CANNOT be combined with Volvo Car Financial Services programs. Must take delivery of vehicle between May 1st 2024 and May 31st, 2024. See your participating Volvo Retailer for details.Clean Vehicle Offer

$7,500Maximum RebateNot available with special financing, lease and some other offers. See dealer for details.Clean Vehicle Offer

$7,500Maximum RebateNot available with special financing, lease and some other offers. See dealer for details.Clean Vehicle Offer

$7,500Maximum RebateEligible customers may receive rebate towards the purchase or finance on select vehicles. Residency restrictions apply.Customer Cash

$7,500Maximum RebateRetail customers may be eligible for cash incentive. Incentive may not be combined with KIA Motor Finance Lease or Special APR financing. Residency restrictions apply.Customer Cash

$7,500Maximum RebateRetail customers may be eligible for cash incentive. Incentive may not be combined with LFS Lease or Special APR financing. Residency restrictions apply.Federal Credit

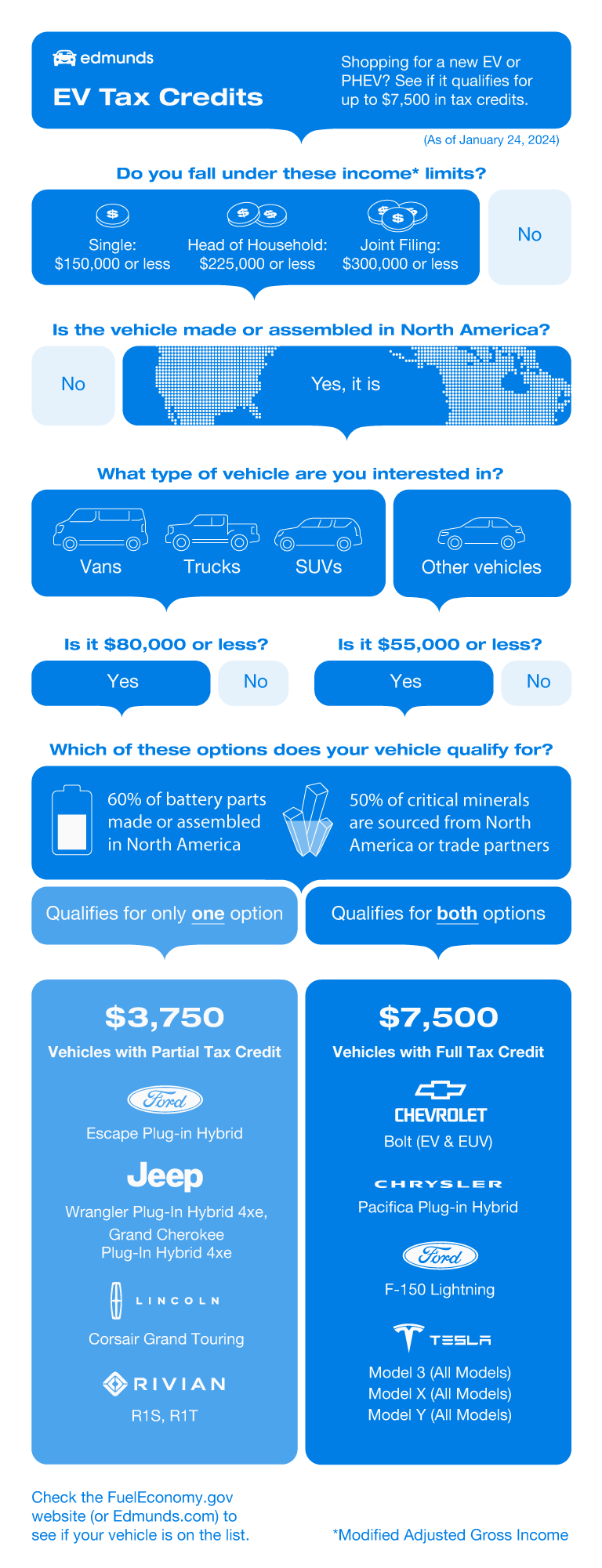

$7,500Maximum RebateUnder the Inflation Reduction Act of 2022, the Internal Revenue Service (IRS) offers taxpayers a Clean Vehicle Tax Credit of $3,750 or $7,500 depending on model eligibility for the purchase of a new plug-in electric vehicle. Beginning January 1, 2024, Clean Vehicle Tax Credits may be initiated and approved at the point of sale at participating dealerships registered with the IRS. Dealers will be responsible for submitting Clean Vehicle Tax Credit information to the IRS. Buyers are advised to obtain a copy of an IRS "time of sale" report, confirming it was submitted successfully by the dealer. To be eligible:

- A vehicle must have undergone final assembly in North America (the United States and Puerto Rico, Canada, or Mexico).

- Critical mineral and battery component requirements determine credit amount.

- Maximum MSRP of $55,000 for cars and $80,000 for SUVs/trucks/vans.

- Income eligibility applies depending on modified adjusted gross income (AGI) and tax filing status.

To learn more, visit https://www.irs.gov/credits-deductions/credits-for-new-clean-vehicles-purchased-in-2023-or-after

Retail Cash

$7,500Maximum RebateGenesis Retail Bonus Cash for customer that purchase a new Genesis model. Not compatible with subvented lease or APR programs.UNKNOWN

$7,500Maximum RebateEligible customers may receive cash incentive. Cash incentive may be incompatible with certain finance types or other cash programs, based on individual program rules. Residency restrictions apply.Military Offer

$5,000Maximum RebateSpecial BMW Incentive offer is valid at any authorized BMW Center in the United States. Incentive offer is subject to change without prior notice. BMW of North America, LLC requires presentation of a photo ID, your BMW Manufacturer Certificate with a unique Customer ID, and Offer Code. One incentive per customer, per offer code, per calendar year for new BMW vehicles. Eligible military member must be the purchaser. See your authorized BMW Center for complete program details.Affiliations, Clubs or Groups Offer

$3,000Maximum RebateMembers of Costco may receive additional support on eligible vehicles purchased or leased.Conquest Offer

$3,000Maximum RebateCurrent owners/lessees of one of the qualifying vehicles (2010 model year or newer AUDI, BMW, FORD, GENESIS, LEXUS, LINCOLN, MERCEDES-BENZ, POLESTAR, RIVIAN, TESLA, VOLVO) are eligible to use this offer toward the purchase or lease of one of the new and unused models.. Trade-in Not Required. Cannot be combined with loyalty offers. Proof of qualifying vehicle required. See dealer for details.Customer Cash

$3,000Maximum RebateReceive a customer bonus when you purchase or lease a select, new Audi.* *Audi of America, Inc. will pay a $3,000 customer bonus when you purchase a new, unused 2024 e-tron GT through participating dealers from May 1, 2024 to June 3, 2024. Customer bonus applied toward MSRP and is not available for cash. May not be combined Puerto Rico Assistance Program. Offer not valid in Puerto Rico. See your local Audi dealer or, for general product information, call 1-800-FOR-AUDI. 2024 Audi of America, Inc.UNKNOWN

$3,000Maximum RebateRetail Bonus Cash (#11198). Eligible buyers may receive Retail Bonus Cash on select new vehicles. Incentive may be incompatible with certain finance types or other cash programs, based on individual program rules. Take new retail delivery from dealer stock by 07/08/2024. Residency restrictions apply. See dealer for qualifications and complete details.

2024 Hyundai IONIQ 5

$7,500Vehicle Rebates+ more qualifying rebates2023 Ford E-Transit Cargo Van

$7,500Vehicle Rebates+ more qualifying rebates2024 Genesis GV60

$7,500Vehicle Rebates+ more qualifying rebates2024 Hyundai IONIQ 6

$7,500Vehicle Rebates+ more qualifying rebates2024 Kia EV9

$7,500Vehicle Rebates+ more qualifying rebates2023 Kia Niro EV

$7,500Vehicle Rebates+ more qualifying rebates2024 Kia EV6

$7,500Vehicle Rebates+ more qualifying rebates2023 Polestar 2

$7,500Vehicle Rebates2024 Acura ZDX

$7,500Vehicle Rebates2023 Tesla Model 3

$7,500Vehicle Rebates2023 Tesla Model Y

$7,500Vehicle Rebates2024 Polestar 2

$7,500Vehicle Rebates2024 Audi e-tron GT

$3,000Vehicle Rebates+ more qualifying rebates2024 Tesla Model Y

$7,500Vehicle Rebates2024 Tesla Model 3

$7,500Vehicle Rebates

Federal EV Tax Credits Overview

Federal EV Tax Credit Incentive #1: North American Final Assembly

Federal EV Tax Credit Incentive #2: Origin of Critical Battery Minerals ($3,750 Tax Credit)

Federal EV Tax Credit Incentive #3: Origin of Battery Components ($3,750 Tax Credit)

Federal EV Tax Credit Incentive #4: No Involvement by Blacklisted Countries After 2023

Federal EV Tax Credit Incentive #5: Price Limits

Federal EV Tax Credit Incentive #6: Buyer Income Limits

FAQ

EV Tax Credits Vehicle Eligibility

More EV News Articles

- Electric Vehicle Tax Credits: What You Need to KnowRonald Montoya•09/08/2022

- Best Electric Cars of 2022 and 2023Edmunds

- Edmunds' EV Buying GuideEdmunds•05/05/2022

- Cheapest Electric CarsEdmunds•03/22/2022

- The True Cost of Powering an Electric CarEdmunds•03/29/2022

- Home EV Charging 101Jonathan Elfalan•04/21/2021

- What's New With GMC? All 2024 and 2025 Changes DetailedChris Bruce•04/29/2024

- Hotter Kia EV9 GT Coming Next YearSteven Ewing•04/27/2024

- 2024 Sierra EV Denali Edition 1 Gets Improved Range and Lower PriceChris Bruce•04/17/2024

- The 2025 Lotus Eletre Is Big, Not Pretty, and Costs Over $100KConnor Hoffman•04/16/2024

- 2024 Chevrolet Silverado EV RST Is Coming With Lower Price and More RangeChris Bruce•04/04/2024