Georgia electric vehicle tax credits, rebates and incentives

Customer Bonus Cash

$10,500Maximum RebateCustomers purchasing select Volkswagen models may be eligible for bonus cash incentive. Cash Bonus is in lieu of VWFS special APR, See your Volkswagen retailer for complete details.Customer Cash

$10,000Maximum RebateCustomer Cash from Kia America for the purchase of a new Kia. Customer Cash must be applied toward the purchase of a new Kia and not available for cash. Subject to vehicle availability and dealer participation. Offers may not be combined except where specified. Must take delivery by 06-02-2025. Limited inventory available. Offer not available for leases. See Kia retailer for available stock.Clean Vehicle Offer

$7,500Maximum RebateEligible customers may receive rebate towards the purchase or finance on select vehicles. Residency restrictions apply.Clean Vehicle Offer

$7,500Maximum RebateGM EV Bonus Cash is only available on select vehicle VINs not eligible for the IRA Clean Vehicle Federal Tax Credit. Not available with special finance or lease offers. Offer terms subject to change. See dealer for details.Customer Bonus Cash

$7,500Maximum RebateEligible customers may receive cash incentive. Cash incentive may be incompatible with certain finance types or other cash programs, based on individual program rules. Residency restrictions apply.Customer Bonus Cash

$7,500Maximum RebateGenesis Retail Bonus Cash for customer that purchase a new Genesis model. Not compatible with subvented lease or APR programs.Customer Cash

$7,500Maximum RebateRetail customers may be eligible for cash incentive. Incentive may not be combined with NMAC Lease or Special APR financing. Residency restrictions apply.Customer Cash

$7,500Maximum RebatePurchase Allowance applies to select MY24 and MY25 Volvo vehicles sold as a cash purchase or financed through Volvo Car Financial Services (VCFS), the Purchase Allowance is not combinable with vehicles sold with the Promotional APR Financing Rate through Volvo Car Financial Services (VCFS). Available to qualified customers that meet Volvo Car Financial Services (VCFS) credit standards at authorized Volvo Cars Retailers. Not everyone will qualify for credit approval. Advertised financing does not include taxes, title, registration, license, and other dealer fees. Car shown with optional equipment. All offers are subject to vehicle availability. Must take delivery of vehicle between May 01, 2025 and June 02, 2025. See your participating Volvo Cars Retailer for details.Federal Credit

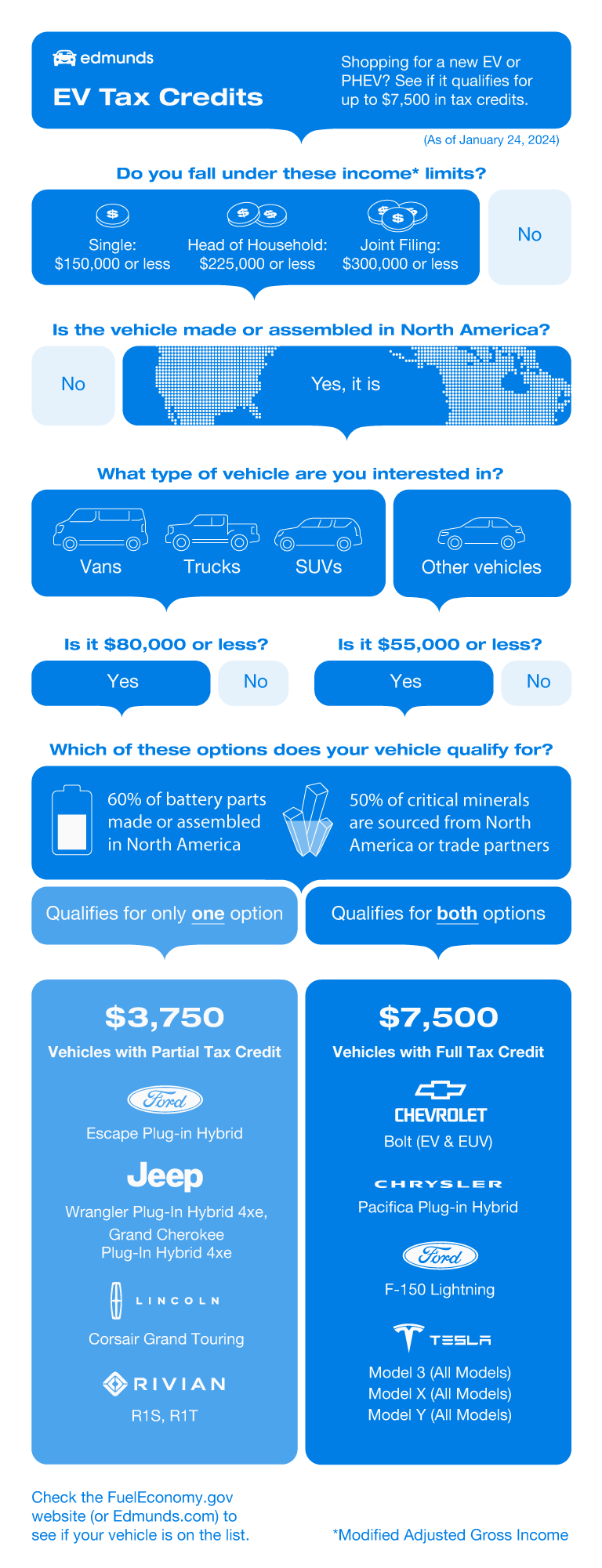

$7,500Maximum RebateUnder the Inflation Reduction Act of 2022, the Internal Revenue Service (IRS) offers taxpayers a Clean Vehicle Tax Credit of $3,750 or $7,500 depending on model eligibility for the purchase of a new plug-in electric vehicle. Beginning January 1, 2024, Clean Vehicle Tax Credits may be initiated and approved at the point of sale at participating dealerships registered with the IRS. Dealers will be responsible for submitting Clean Vehicle Tax Credit information to the IRS. Buyers are advised to obtain a copy of an IRS "time of sale" report, confirming it was submitted successfully by the dealer. To be eligible:

- A vehicle must have undergone final assembly in North America (the United States and Puerto Rico, Canada, or Mexico).

- Critical mineral and battery component requirements determine credit amount.

- Maximum MSRP of $55,000 for cars and $80,000 for SUVs/trucks/vans.

- Income eligibility applies depending on modified adjusted gross income (AGI) and tax filing status.

To learn more, visit https://www.irs.gov/credits-deductions/credits-for-new-clean-vehicles-purchased-in-2023-or-after

Employee Pricing

$7,440Maximum RebateMinimum Employee Pricing Discount based on the lowest invoice price of the 2024 model and trim with base configuration and engine type. Actual discount may vary. Non-FCA employees and retirees may purchase an eligible 2024 and 2025 FCA US LLC vehicle at the Employee Price from a participating dealership. Price includes a $200 administrative fee. Excludes fleet sales. Additional terms and restrictions apply; not all purchasers will qualify. Not compatible with consumer lease incentives and standalone incentive programs. Contact your dealer to review pricing on your vehicle of interest. Offer ends 06/02/2025. (D29HR6)Employee Pricing

$6,529Maximum RebateMinimum Employee Pricing Discount based on the lowest invoice price of the 2024 model and trim with base configuration and engine type. Actual discount may vary. Non-FCA employees and retirees may purchase an eligible 2024 and 2025 FCA US LLC vehicle at the Employee Price from a participating dealership. Price includes a $200 administrative fee. Excludes fleet sales. Additional terms and restrictions apply; not all purchasers will qualify. Not compatible with consumer lease incentives and standalone incentive programs. Contact your dealer to review pricing on your vehicle of interest. Offer ends 06/02/2025. (T29HR6)Employee Pricing

$6,433Maximum RebateMinimum Employee Pricing Discount based on the lowest invoice price of the 2024 model and trim with base configuration and engine type. Actual discount may vary. Non-FCA employees and retirees may purchase an eligible 2024 and 2025 FCA US LLC vehicle at the Employee Price from a participating dealership. Price includes a $200 administrative fee. Excludes fleet sales. Additional terms and restrictions apply; not all purchasers will qualify. Not compatible with consumer lease incentives and standalone incentive programs. Contact your dealer to review pricing on your vehicle of interest. Offer ends 06/02/2025. (J29HR6)In Stock Inventory Offer

$5,500Maximum Rebate2024 Mach-E/Lightning VIN Specific Bonus Cash (#32578). Eligible buyers may receive 2024 Mach-E/Lightning VIN Specific Bonus Cash on select new vehicles. Incentive may be incompatible with certain finance types or other cash programs, based on individual program rules. Take new retail delivery from dealer stock by 07/07/2025. Residency restrictions apply. See dealer for qualifications and complete details.Military Lender Offer

$5,000Maximum RebateSpecial BMW Incentive offer is valid at any authorized BMW Center in the United States. Incentive offer is subject to change without prior notice. BMW of North America, LLC requires presentation of a photo ID, your BMW Manufacturer Certificate with a unique Customer ID, and Offer Code. One incentive per customer, per offer code, per calendar year for new BMW vehicles. Eligible military member must be the purchaser. See your authorized BMW Center for complete program details.Customer Bonus Cash

$4,000Maximum RebateRetail Bonus Cash (#11442). Eligible buyers may receive Retail Bonus Cash on select new vehicles. Incentive may be incompatible with certain finance types or other cash programs, based on individual program rules. Take new retail delivery from dealer stock by 07/07/2025. Residency restrictions apply. See dealer for qualifications and complete details.Customer Cash

$3,750Maximum RebateContact dealer for details. Must take delivery by 06/02/2025. (24CR1)

2024 Mercedes-Benz EQB

$300Charging Rebates2024 Tesla Cybertruck

$300Charging Rebates2024 BMW i4

$300Charging Rebatesqualifying rebates available2024 Lucid Air

$300Charging Rebates2025 Mercedes-Benz eSprinter

$300Charging Rebates2025 Audi RS e-tron GT

$300Charging Rebatesqualifying rebates available2025 Porsche Macan

$300Charging Rebates2025 Volvo EX30

$300Charging Rebatesqualifying rebates available2025 Audi Q6 e-tron

$300Charging Rebatesqualifying rebates available2024 Audi Q4 e-tron

$300Charging Rebatesqualifying rebates available2025 Lexus RZ

$300Charging Rebates2024 Audi SQ8 Sportback e-tron

$300Charging Rebates2025 Ram ProMaster EV Step Van

$300Charging Rebatesqualifying rebates available2024 Porsche Taycan

$300Charging Rebates2025 Cadillac ESCALADE IQ

$300Charging Rebates

Federal EV Tax Credits Overview

Federal EV Tax Credit Incentive #1: North American Final Assembly

Federal EV Tax Credit Incentive #2: Origin of Critical Battery Minerals ($3,750 Tax Credit)

Federal EV Tax Credit Incentive #3: Origin of Battery Components ($3,750 Tax Credit)

Federal EV Tax Credit Incentive #4: No Involvement by Blacklisted Countries After 2023

Federal EV Tax Credit Incentive #5: Price Limits

Federal EV Tax Credit Incentive #6: Buyer Income Limits

FAQ

EV Tax Credits Vehicle Eligibility

More EV News Articles

- Electric Vehicle Tax Credits: What You Need to KnowRonald Montoya•09/08/2022

- Best Electric Cars of 2022 and 2023Edmunds

- Edmunds' EV Buying GuideEdmunds•05/05/2022

- Cheapest Electric CarsEdmunds•03/22/2022

- The True Cost of Powering an Electric CarEdmunds•03/29/2022

- Home EV Charging 101Jonathan Elfalan•04/21/2021

- The Best Cars (Currently) Made in AmericaBrian Wong•05/23/2025

- 2025 Chevy Silverado EV Work Truck: More Range Than Any Other EV We've Ever TestedReese Counts•05/05/2025

- The Slate Auto $20,000 Electric Truck Has Huge Potential but Many UnknownsClint Simone•04/25/2025

- 2025 Chevy Blazer EV SS First Drive: The Only EV You'll Ever Need?Cameron Rogers•04/22/2025

- 2026 Kia EV9 Nightfall First Look: Back in BlackJosh Jacquot•04/16/2025