- Near-new used vehicles are beginning to run in short supply, and prices are rising for this highly coveted sector of the market.

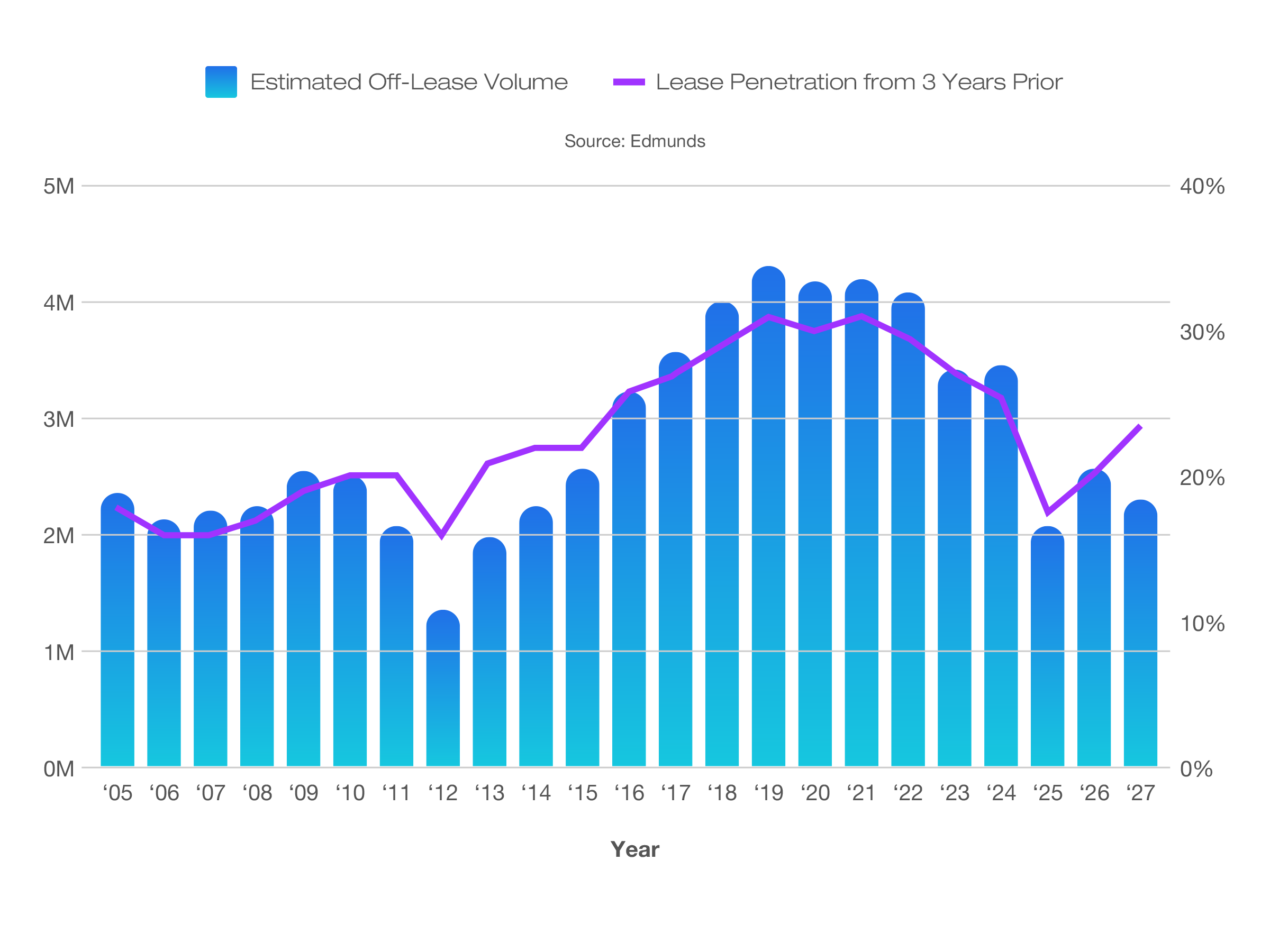

- Recent annual lows in new-vehicle sales combined with low lease penetration have resulted in the lowest level of 3-year-old lease returns since 2013.

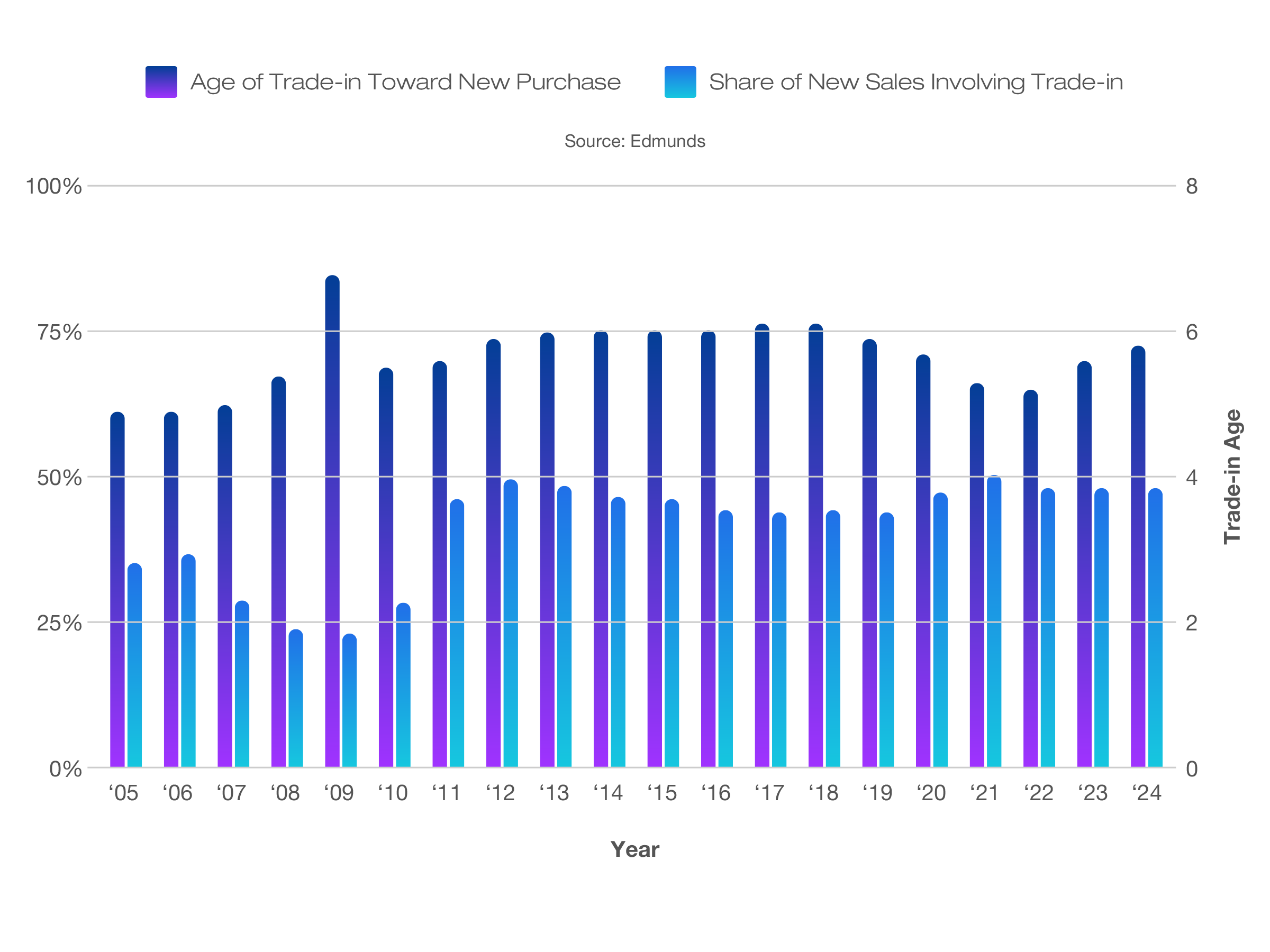

- Holdout buyers are returning, but the average age of their trade-ins is up, leaving a less desirable vehicle mix in the used market.

A Used Car Inventory Crunch Means High Prices Won't Budge for Shoppers in 2025

Data from Edmunds shows that years of disrupted new-car sales are catching up to the used market, limiting inventory and keeping prices high

As the new-car market shows continued signs of recovery following supply strain from semiconductor chip shortages spurred by the pandemic, the used car market is now reliving that challenging past. With the inherent interconnectedness between new-vehicle sales and used vehicle inventory, it was only a matter of time before the used market would feel the repercussions of reduced new-car sales from three years ago. Unfortunately, that time is now.

The state of the used vehicle market in Q4 2024

Prices of 3-year-old used vehicles increased by 3.3% year over year to $29,710 on average in Q4 2024, up from $28,772. The rise in value is joined by slower turnover at used car dealerships: The average days to turn — the number of days a vehicle sits on a dealer lot before a sale — for used vehicles was 40 days, three days more than a year prior, according to Edmunds data. This minor increase in days to turn can be chalked up to seasonality, as the last five years have seen an average increase of nearly five days from Q3 to Q4.

In 2024, car shoppers experienced the trickle-down effects of discounts on stale new-car inventory pushing prices lower for the newest used vehicles. While this top-down pressure should continue into 2025, the relief in pricing will likely meet resistance in an even tighter supply of used vehicles after years of reduced new-car sales volumes, fewer off-lease units returning to the market and an aging trade-in population.

For used-car shoppers who have held off on a purchase with hopes of a more stable market and stronger discounts, 2025 could prove to be a challenging environment from both selection and pricing perspectives.

COVID-era new-car supply issues come back to bite used car sales in 2025

The COVID-era chip shortages that plagued new-car sales from 2020 through 2024 are back, indirectly, to unleash their wrath on used sales today. Compounding the reduced availability of near-new used vehicles today is an aggressive run-up in average transaction prices (ATPs) that coincides with limited supply.

While higher ATPs don’t always translate to higher resale values, even placing a very conservative 60% residual value on a 3-year-old vehicle originally sold as new in 2022 would result in an average resale value of $28K, which isn’t too far off from the average price of a 3-year-old vehicle today ($30,789).

Pricing aside, selection and inventory resulting from these deficit years will be lacking by millions of units, heightening the shopping challenge for today’s buyers. That said, the availability struggles are still less devastating than the period from 2008 to 2013, when a recession and ensuing new-car sales slump left an even deeper trough in secondhand vehicles to buy and sell.

It’s not just fewer sales. It’s the limited volume of a specific vehicle age that’s impacting the market

Three-year-old used vehicles are the cornerstone of the used car market: They are typically the most desired, generally still offer some form of factory warranty, and represent a good value for those uninterested in spending new-car money. 2025 will be defined by its dearth of these popular models because 2022 was one of lowest new-car sales volume years in recent memory with only 13.8 million sales (the lowest since 2011’s 12.8 million sales). Because lease deals dry up when demand is strong, those low sales tallies were then coupled with a lease penetration rate of only 18%, leaving just 2 million potential 3-year-old lease returns in 2025. That’s a far cry from the norm of 4 million returned leases from the late 2010s, when new-car sales volumes were closer to the 17 million mark with a 30% lease penetration rate.

New-car sales are projected to improve, but used vehicles will skew older as holdout buyers return with older trades

The Edmunds new-car sales forecast is pointing toward a year-over-year increase from 2024’s 15.98 million figure to 16.2 million in 2025. On the surface, an increase in new-vehicle purchases should be a sign that we’ll see more used cars hit the market as trade-ins. Unfortunately, the share of new-car sales involving a trade-in generally only hovers around the mid-40% range. And as many shoppers have waited out the difficult market in search of greater new-vehicle inventory and lower prices, the average age of vehicles traded in as part of new-vehicle purchases is ticking up, contributing to the less desirable mix of vehicles in the used market.

Proportionally, used car sales garner a lower share of trade-ins compared to new purchases, typically coming in slightly below one-third of all used sales. The trade-ins involved in these purchases are also much older than those associated with new-vehicle purchases. As the new-vehicle market returns to normalcy, many traditional new-car shoppers are returning to that end of the market and bringing their nicer trade-ins with them, rather than shopping used. In turn, the trade-ins coming in as part of used vehicle purchases have climbed to an average age of 9 years, in line with prepandemic trends.

Despite the trend of increasing trade-in ages, 3-year-old vehicles remain the most frequently traded as part of both new and used sales. As a result, near-new used inventory will continue to benefit from these trades, helping offset the deficit caused by fewer lease returns. As shown in the chart, the trade-in age distribution has a long, relatively smooth tail, which will push down prices across the market.

Edmunds says

Holdout buyers with hopes of returning to a market resembling the pre-COVID era are being greeted with mixed results. New-vehicle availability has improved greatly, and new cars are once again sitting on dealer lots long enough to encourage discounts. But new-car prices are still higher than ever, and years of low new-car sales now have used-car shoppers feeling the effects of a used vehicle inventory shortage.

2025 may also be the start of another pendulum swing: If prices for used vehicles hold steady or rise further as supply dwindles, some used-car shoppers might entertain the idea of checking out new vehicles as discounts and incentives make a jump to the new-car smell more appealing.

by

by  edited by

edited by