2023 Jaguar I-PACE Review

View 53 more photos

View 53 more photos View 53 more photos

View 53 more photos View 53 more photos

View 53 more photos View 53 more photos

View 53 more photos View 53 more photos

View 53 more photos2023 Jaguar I-PACE Review

What's new

- Apple CarPlay and Android Auto now have wireless integration

- Integrated Amazon Alexa voice assistant

- Wireless smartphone charging is now standard

- Part of the first I-Pace generation introduced for 2019

2023 Jaguar I-PACE EV Insights

Estimated Range Based on Age

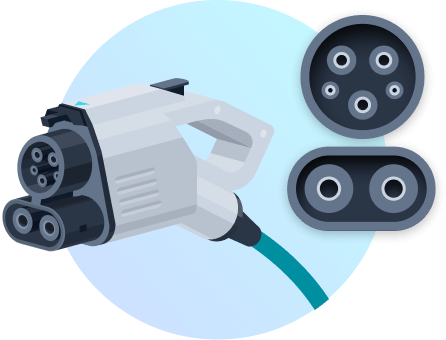

Charging

EV Battery Warranty

EV Tax Credits & Rebates

- Restrictions:

Clean Cars 4 All (CC4A) through the Bay Area Air Quality Management District (BAAQMD) offers income qualified residents a standard grant of $10,000, or a total of $12,000 (which requires residency in a disadvantaged community census tract). Offer is available for scrapping a qualifying old vehicle and replacing it with the purchase or lease of a battery electric vehicle. To qualify:

- Income eligible applicant must currently reside within the jurisdiction of the BAAQMD.

- Application approval, scrap vehicle pre-inspection, and grant award letter required prior to purchase or lease of an 8 year old or newer vehicle with less than 75,000 miles on the odometer from an authorized participating dealer.

- Maximum sale price of replacement vehicle not to exceed $48,000.

- Vehicle to be scrapped must be functioning and be a model year of 2007 or older.

- Must have a California registration for at least the past 2 years. Exceptions allowed.

- Previous participation in other vehicle related assistance programs may affect eligibility.

Additional information:

- For the $10,000, applicants must have an income at or below 300% of the current Federal Poverty Level as defined by the U.S. Department of Health and Human Services.

- For the $12,000, must also reside in a disadvantaged community census tract.

- Participants may qualify for an additional Electric Vehicle Charger Rebate, choosing between a $2,000 rebate for a Level 2 home charger installation or a $1,000 Level 2 portable charger.

- Participants who do not want to replace their old vehicles may obtain a $7,500 credit that can be used towards the purchase of an e-Bike and/or applied to a Clipper Card for public transit usage.

To learn more, visit BAAQMD CC4A

- Restrictions:

The California Air Resources Board (CARB) through the Driving Clean Assistance Program (DCAP) offers two pathways for applicants: the Clean Cars 4 All route or Financial Assistance route. The path outlined here is for the Financial Assistance, offering a standard down payment assistance grant of $7,500 towards the purchase or lease of an 8 year old or newer battery electric vehicle. Scrapping and replacing a vehicle is not required. Check with your local Air District for any available programs that may take precedence over the DCAP programs. To qualify:

- Income eligible applicant must be a California resident.

- Application approval required prior to purchasing or leasing from an authorized participating dealership.

- Maximum purchase price of replacement vehicle not to exceed $45,000.

- Previous participation in other CARB funded programs may affect eligibility.

Additional information:

- For the $7,500, must have an income at or below 300% of the current Federal Poverty Level as defined by the U.S. Department of Health and Human Services.

- Participants may qualify for an additional charging grant, choosing between $2,000 for the purchase and install of Level 2 home charging equipment or $2,000 for a public charging card.

- Fair financing may be available, capped at $45,000 with an interest rate no more than 8%.

To learn more, visit Driving Clean Assistance Program

- Restrictions:

PG&E offers EV owners a rebate of up to $4000 towards the purchase or lease of a qualified used electric vehicle.

To qualify for this rebate, the customer and/or vehicle must meet the following requirements:

- Receive electricity from PG&E.

- Have purchased or leased an electric or plug-in hybrid vehicle.

Additional Information:

- Enrollment in qualified public assistance program and income restrictions do apply.

To learn more, visit https://evrebates.pge.com/program-requirements

- Restrictions:

Under the Inflation Reduction Act of 2022, the Internal Revenue Service (IRS) offers taxpayers a Used Clean Vehicle Tax Credit equal to 30% of the sale price up to a maximum credit of $4,000 for the purchase of a used plug-in electric or hydrogen fuel cell vehicle. Beginning January 1, 2024, Clean Vehicle Tax Credits may be initiated and approved at the point of sale at participating dealerships registered with the IRS. Dealers will be responsible for submitting Clean Vehicle Tax Credit information to the IRS. Buyers are advised to obtain a copy of an IRS "time of sale" report, confirming it was submitted successfully by the dealer. Not every version of the vehicle models will necessarily qualify. Please check with the dealer/seller to determine the eligibility of your specific vehicle.

For the vehicle to qualify:

- Price cannot exceed $25,000.

- Need to verify the Vehicle Identification Number (VIN).

- Must be at least two model years older than the current calendar year in which the vehicle was purchased.

- Must be sold through a dealership, private sales not permitted.

- Not have already been transferred after August 16, 2022, to a qualified buyer.

For individuals to qualify:

- Must meet income eligibility, depending on modified adjusted gross income (AGI) and tax filing status.

- Must not be the first owner of the qualifying vehicle.

- Has not been allowed a credit under this section for any sale during the 3-year period ending on the date of the sale of such vehicle.

- Purchased for personal use, not a business, corporation or for resale.

To learn more, visit https://www.irs.gov/credits-deductions/used-clean-vehicle-credit

- Restrictions: Edmunds is partnering with Treehouse, an independent provider of home EV installation services. Edmunds visitors receive a $100 discount when they contract with Treehouse for their home charger installation. Discount excludes permit, hosted inspection, and load management devices. Valid for 30 days.

To learn more, visit https://treehouse.pro/edmundsdiscount/

- Restrictions:

Pacific Gas & Electric Co. offers EV owners a free Level 2 charging station valued at $500.

To qualify for this rebate, the customer and/or charging station must meet the following requirements:

- Receive electricity from Pacific Gas & Electric Co..

- Have purchased or leased an electric or plug-in hybrid vehicle.

To learn more, visit https://www.pge.com/en/clean-energy/electric-vehicles/empower-ev-program.html

Cost to Drive

Am I Ready for an EV?

- EV ownership works best if you can charge at home (240V outlet)

- Adding a home charging system is estimated to cost $1,616 in

- Edmunds is partnering with Treehouse, an independent provider of home EV installation services. Learn more about the installation services partnership

Jaguar I-PACE Owner Reviews

Most Helpful Owner Reviews

Trending topics

I LOVE I-PACE!

5 out of 5 starsHonest John. Jaguar I Pace Owner

4 out of 5 starsAfter rough start my I-Pace is great

4 out of 5 starsBest EV - Best Car in its Class - Love it!

5 out of 5 stars2023 I-PACE Highlights

| Base MSRP Excludes Destination Fee | $71,300 |

|---|---|

| EV Tax Credits & Rebates | |

| Engine Type | Electric |

| Edmunds Tested Electric Range | 262 miles vs EPA Range 246 miles |

| Cost to Drive | $165/month |

| Total Charging Time (240V) | 13.0 hours |

| Seating | 5 seats |

| Cargo Capacity All Seats In Place | 25.3 cu.ft. |

| Drivetrain | all wheel drive |

| Warranty | 5 years / 60,000 miles |

| EV Battery Warranty | 8 years / 100,000 miles |

Safety

Our experts like the I-PACE models:

- Adaptive Cruise Control w/ Steering Assist

- Adjusts speed to maintain a constant distance between the Jaguar and the car in front.

- Lane Keep Assist

- Steers the I-Pace back into its lane if it begins to drift over the lane marker.

- Blind Spot Assist and Rear Traffic Monitor

- Alerts you if a vehicle is in your blind spot during a lane change or while in reverse.

People who viewed this also viewed

| Starting at $49,500 |

| Starting at $77,900 |

| 5.0 average Rating out of 1 reviews. |

| Starting at $49,800 |

Related Used 2023 Jaguar I-PACE info

Vehicle reviews of used models

- Ford Fusion Hybrid 2020 Review

- Mercedes Benz Metris 2020 Review

- BMW 3 Series 2020 Review

- Volkswagen Atlas 2020 Review

- Mercedes Benz A Class 2020 Review

- Toyota Prius 2021 Review

- Genesis G70 2021 Review

Shop similar models

- Used Audi A6-sportback-e-tron 2025

- Used Audi S6-sportback-e-tron 2025

- Used Polestar 2 2024

- Used Mercedes-benz B-class-electric-drive 2017

- Used Volvo C40-recharge 2024

- Used Volvo Ex30 2025

- Used BMW I5 2026

- Used BMW I4 2025

- Used BMW I7 2025

Shop used vehicles in your area

Popular new car reviews and ratings

Research other models of Jaguar

- Jaguar F-TYPE 2024

- 2026 F-PACE

- New Jaguar XF

- New Jaguar I-PACE

- New Jaguar F-PACE

- 2024 Jaguar E-PACE

- 2024 F-PACE

- 2025 Jaguar F-PACE

- 2024 Jaguar F-TYPE

Research similar vehicles

Other models

- Used Audi A4-Allroad in Yankton, SD 2025

- Used Mercedes-Benz Slc-Class in District Heights, MD 2020

- Used Suzuki Forenza in Elizabethport, NJ 2008

- Used Chrysler Aspen in San Diego, CA 2009

- Used Nissan Titan in Thomasville, NC 2024

- Used Jeep Compass in Hershey, PA 2025

- Used Volvo XC90 in Grand Junction, CO 2026

- Used Mercedes-Benz 560-Class in Manteca, CA 1991

- New Cadillac XT6 for Sale in Danville, CA

- Used Chevrolet Silverado-3500Hd in Oakley, CA 2025