Edmunds Car News

Latest Car News

Spotlight

Must Watch

Watch Video

2026 BMW iX3 First Look

Clint Simone gives you the rundown on the iX3 and what it means for BMW's future.

Electric Vehicle News

Podcasts

Market Insights

More car news articles

- The 2026 Nissan Z Heritage Edition Channels GT-R Energy09/09/2025

- 2026 Polestar 5 First Look: An Electric Porsche Fighter With No Rear Window09/08/2025

- Zzzap! Mercedes Is Working on 1-Megawatt EV Fast Charging09/07/2025

- 2027 Mercedes-Benz GLC EV First Look: An Electric Luxury SUV for the Masses09/07/2025

- 2026 Porsche 911 Turbo S: This 701-HP Hybrid Does 0-60 in 2.4 Seconds09/07/2025

- Why I Bought a Subaru BRZ After Years of Driving Supercars09/06/2025

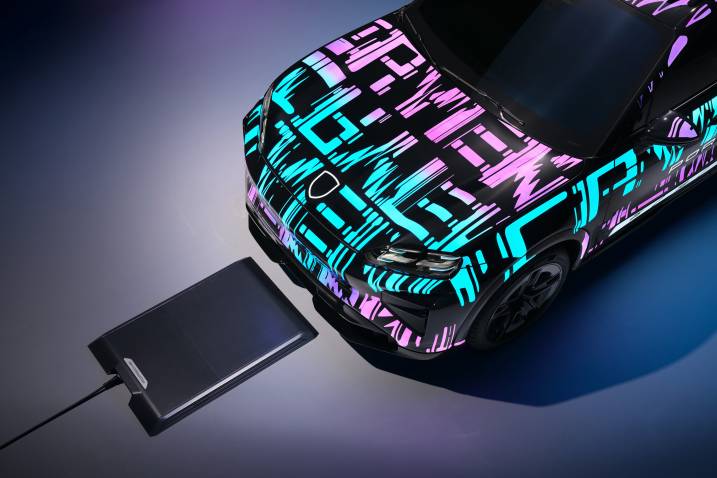

- 2027 BMW iX3 First Look: A Massive Shake-Up09/05/2025

- 2027 Mercedes-Benz GLC EV Flaunts Its 39-Inch Hyperscreen09/05/2025

- Mercedes-Benz Will Bless the World With a New G-Class Convertible09/04/2025

- Hyundai Palisade vs. Mazda CX-90 vs. Toyota Grand Highlander: Which Three-Row SUV Is Best?09/04/2025