If you were in the car business three years ago, you probably remember how great 2016 was. Between January 1 and December 31, the American car market delivered 17.5 million new units — the most ever.

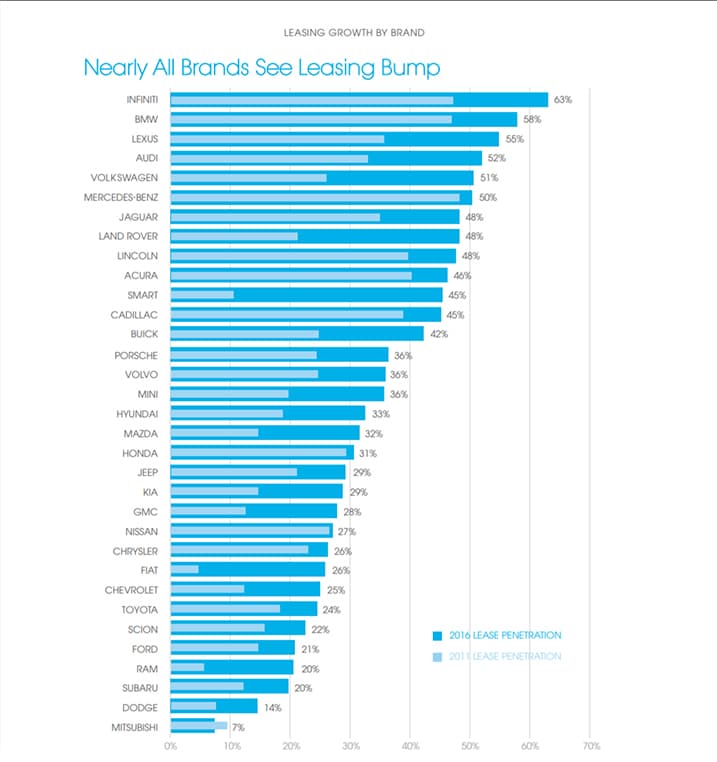

While most of the media (including us here at Edmunds) was buzzing about smashed sales records, another record was quietly broken: lease adoption rates.

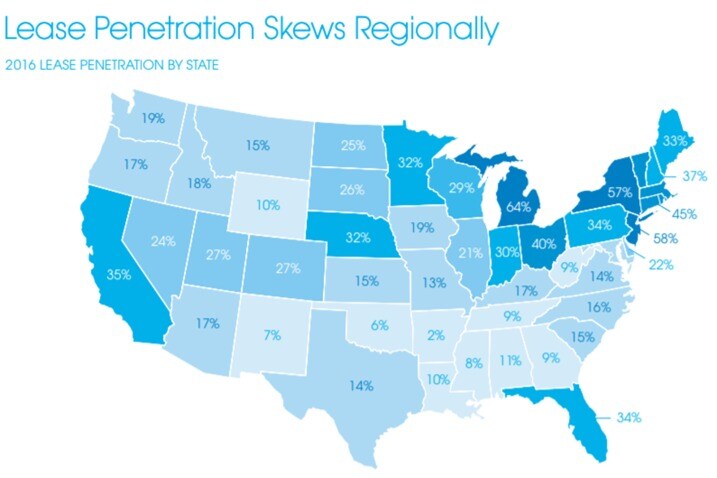

The 2016 leases numbered 4.3 million — 31 percent of all car deals that year. Both the amount and the percentage were record highs. Cars and SUVs accounted for the majority. Only 320,000 of these deals were for trucks.

Now here we are in 2019, and most of those 4.3 million leases — along with the people who drive them — will be returning to your dealerships looking to get something new.

2016 vehicles, and their lessees, are coming back — to higher prices

In the past, getting returning lessees into new cars was usually pretty easy. Many would simply pick out the new version of what they have, sign a few documents, and hit the road.

It might not be quite as easy now.

Transaction data tells us that across the board, vehicle leases will cost customers about $1,600 more over the term compared to three years ago. Sedans seem to be hit the hardest. Here are some examples:

2016 vs. 2019 average lease costs (most popular 2016 lease vehicles)

Toyota Camry SE (+26%) $77 more per month

Toyota Corolla LE (+22%) $51 more per month

Honda Civic LX (+19%) $45 more per month

As a dealership professional, you may already be familiar with these price jumps. You likely understand these changes are due to rising interest rates, higher sticker prices and, in some cases, lower residual values or tightening lending criteria.

To your customer, who probably isn't in the car business and may not understand all the factors that go into structuring a lease, these new numbers just might not make sense. This disconnect can easily disrupt a deal.

What this means to you

I regularly spend time in dealerships, and in the last several months I've seen sales teams struggle to handle repeat or returning lease customers. In one store, a sales manager told me that many of his leasing customers are simply opting to extend their current lease instead of transacting again.

Here's the good news: It may not have to be this way. You likely still have an opportunity to serve your returning lessee. You just might need to prepare your staff in advance.

Roadmap to success

Consider this: Many dealerships have a process to handle first-time buyers, shoppers with poor credit or those who are upside down. Have you created a strategy to handle returning lessees in this new landscape? Here are some ideas:

- Train sales staff to give demos that highlight improvements, which may help justify a higher payment. Does the new car have Apple CarPlay or Android Auto? New standard safety features or better fuel economy? Show off those new bells and whistles!

- Create lease buyout programs (including warranty and GAP) for shoppers who like their car and want to stop leasing.

- Suggest CPO vehicles to returning lessees who need to keep payments low but like the assurance of a warranty. Pro tip: Don't assume your shoppers know what CPO vehicles are or the program benefits. You might consider directing customers to the top CPO-related pages viewed on Edmunds: "What Are Certified Pre-Owned Vehicles?" and "Certified Pre-Owned Cars vs. Used Cars With Extended Warranties."

- Encourage shoppers to switch vehicle type.

- Example: A Honda shopper choosing between an Accord LX and a CR-V LX AWD in 2016 would have had to pay about $2,000 more over the term of the lease for the SUV. Transaction data tells us that leasing a 2019 CR-V LX AWD would only cost about $1 more per month than a 2019 Accord LX.

- Some customers who wouldn't pay $50 more per month for a new version of their same car may be just fine making the bump for something different.

Our sample suggestions may not be perfect for you or your specific needs. As a dealer, you know what works best for your market, your staff, your OEMs and your franchise goals.

The key takeaway here is that, with a plan, you may be able to keep shoppers from defecting from your brand or dealership based on payment alone.

SUV shoppers might have it easier

While the sedan segment is seeing some significant jumps in monthly lease payments, SUV prices seem to be a bit more stable. A good example would be the Chevrolet Equinox LT AWD. Its lease price hasn't increased much, according to early transaction data from this year. A 2019 Equinox will only cost about $200 more for a 36-month lease than it did three years ago.

Honda's CR-V LX AWD and Jeep's Grand Cherokee Limited AWD had small price increases, too.

So if you sell a brand with similar lease terms to 2016, you've got a competitive advantage. And you might want to highlight that to your customers.

Edmunds says

With some planning, preparation and a process, chances are good you can save some deals that may have otherwise slipped away.

Some things to think about while developing your system:

- Your staff: Are your salespeople young or new to the business? Can they explain to customers why the new lease payment is much more than what they currently pay? Many of the salespeople at dealerships I visit weren't selling cars three years ago and are just as confused as shoppers are.

- Your customers: If your customer base is payment-focused, are you creating lease programs that will help keep costs down when possible and ordering inventory to support cheap leases?

- Lease buyouts can be a win-win: Some people lease because they just want low payments on a worry-free car. A lease buyout package that includes a warranty and prepaid maintenance might be a perfect solution for these shoppers.

- Lenders: Is your finance department partnering with banks and credit unions that allow for longer-term used car loans to help keep payments low for lease buyouts and CPO purchases?

- Switching segments within your brand: A different vehicle type may justify a payment increase; teach salespeople how to build value in what might be a completely new consideration for your customer.

- If you've got it, flaunt it: Can you still write new leases that don't cost much more than they did in 2016? Highlight these deals in your lease retention marketing.

I hope this helps. Happy selling!

Does your store already have a lease-return plan in place? Share your story with us!

For more info contact your Edmunds rep, call 855-EDMUNDS or email dealersupport@edmunds.com.

You can also check out our 2017 lease report for more details on how leasing has affected the market.

About Matt Jones

Before joining Edmunds, Matt spent a dozen years in some of SoCal's busiest car dealerships. Now, he helps make sense of the retail automotive landscape for car shoppers, car sellers and the media.

Contact Matt on Twitter at @supermattjones or email him: matthewj@edmunds.com.